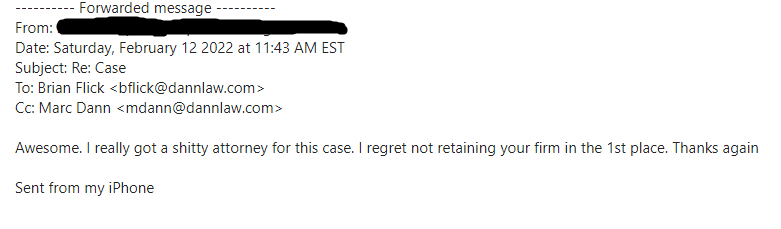

We love receiving shout-outs from our clients—even from those who took a little while to become our clients.

We love receiving shout-outs from our clients—even from those who took a little while to become our clients. From: xxxx

From: xxxx

Sent from my iPhone

DannLaw

Sent from my iPhone

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Liner Legal is a disability law firm, serving clients in the state of Ohio and beyond. Our team specializes in Social Security Disability, Long-term Disability, Short-term Disability, Deaf Discrimination, and more. One of the most common questions clients ask our staff is; How do I win my disability case? While each case is very different, Liner Legal Managing Partner Michael Liner wants to share his top seven secrets to help you win a disability case!

Liner Legal is a disability law firm, serving clients in the state of Ohio and beyond. Our team specializes in Social Security Disability, Long-term Disability, Short-term Disability, Deaf Discrimination, and more. One of the most common questions clients ask our staff is; How do I win my disability case? While each case is very different, Liner Legal Managing Partner Michael Liner wants to share his top seven secrets to help you win a disability case!

Mortgage loan servicers often provide inaccurate and/or incomplete information about the loss mitigation options available to borrowers leaving forbearance or seeking loan modifications.

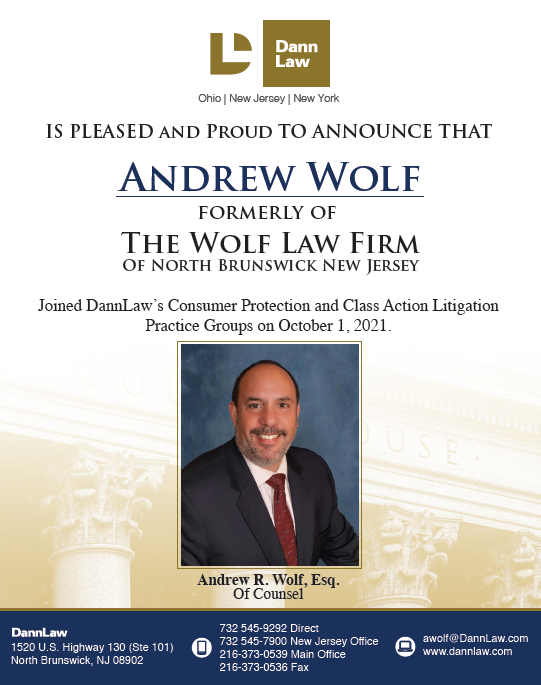

Mortgage loan servicers often provide inaccurate and/or incomplete information about the loss mitigation options available to borrowers leaving forbearance or seeking loan modifications. DannLaw founder and former Ohio Attorney General Marc Dann announced today that Attorney Andrew Wolf of North Brunswick, New Jersey has become an “Of Counsel” member of DannLaw’s Consumer Protection and Class Action Litigation Practice groups. Wolf, who has earned a reputation as one of the nation’s most effective consumer advocates will be based in DannLaw’s New Jersey/New York office.

DannLaw founder and former Ohio Attorney General Marc Dann announced today that Attorney Andrew Wolf of North Brunswick, New Jersey has become an “Of Counsel” member of DannLaw’s Consumer Protection and Class Action Litigation Practice groups. Wolf, who has earned a reputation as one of the nation’s most effective consumer advocates will be based in DannLaw’s New Jersey/New York office.