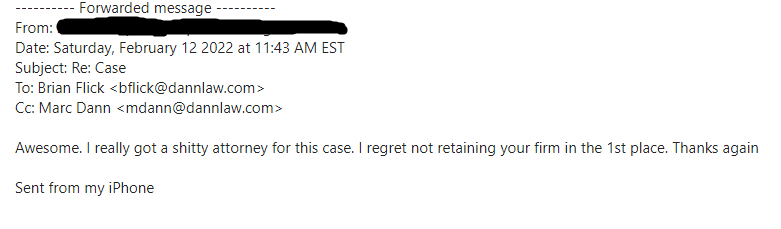

We love receiving shout-outs from our clients—even from those who took a little while to become our clients.

We love receiving shout-outs from our clients—even from those who took a little while to become our clients. From: xxxx

From: xxxx

Sent from my iPhone

DannLaw

Sent from my iPhone

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

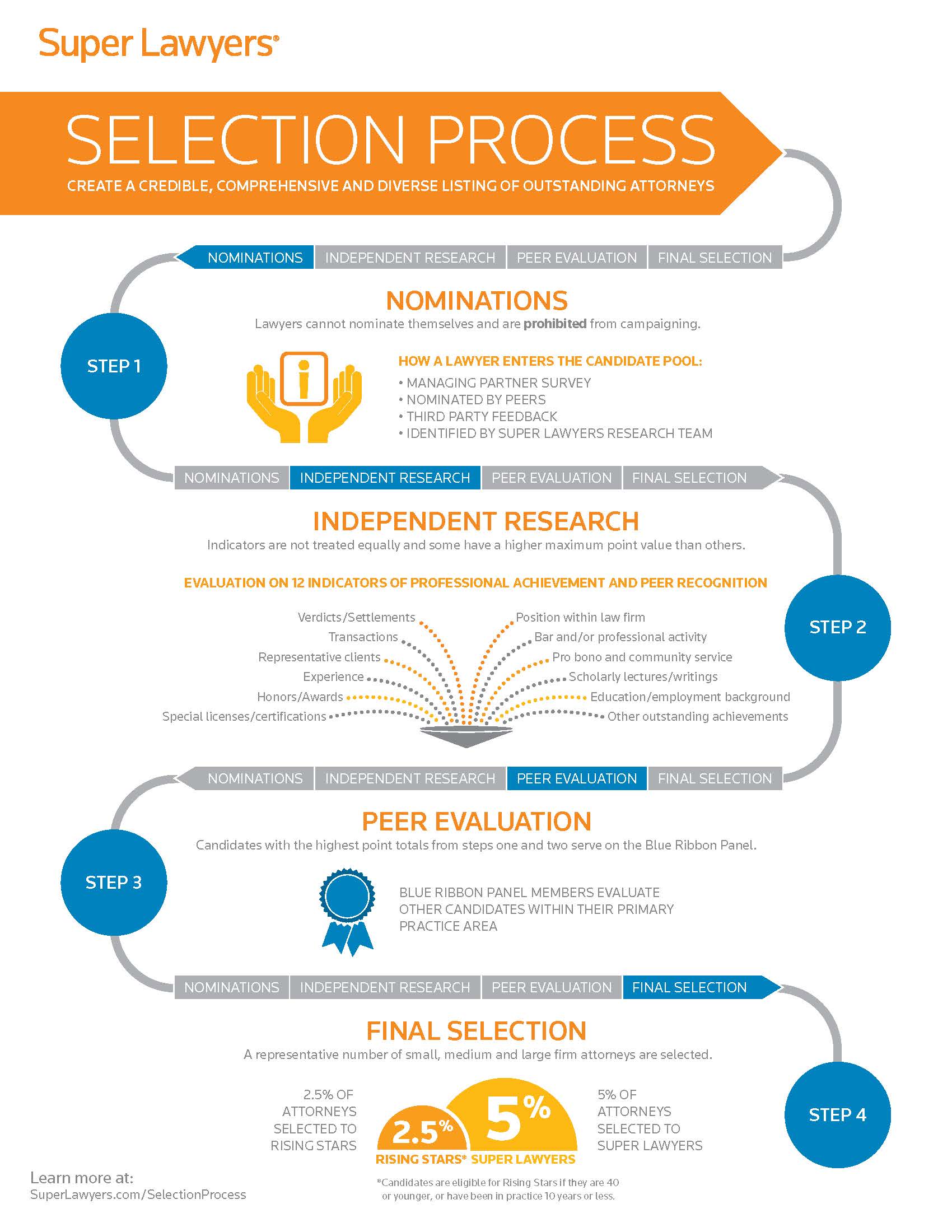

One of America’s most prestigious attorney rating services has just confirmed what his colleagues at DannLaw and the thousands of clients he has represented have long known: Brian Flick is a “SuperLawyer” in the field of consumer law. Super Lawyers selects attorneys using a patented multi-phase process that combines peer nominations and evaluations with independent research. Each candidate is evaluated on 12 indicators of professional achievement. Those who score highest then undergo a “blue ribbon” peer review by practice area. Only the highest-rated attorneys make the Super Lawyer list for each state and the designation is reserved for attorneys who excel in their field, contribute to their community, and abide by the highest professional and ethical standards. We are extremely proud that Brian is listed among them.

One of America’s most prestigious attorney rating services has just confirmed what his colleagues at DannLaw and the thousands of clients he has represented have long known: Brian Flick is a “SuperLawyer” in the field of consumer law. Super Lawyers selects attorneys using a patented multi-phase process that combines peer nominations and evaluations with independent research. Each candidate is evaluated on 12 indicators of professional achievement. Those who score highest then undergo a “blue ribbon” peer review by practice area. Only the highest-rated attorneys make the Super Lawyer list for each state and the designation is reserved for attorneys who excel in their field, contribute to their community, and abide by the highest professional and ethical standards. We are extremely proud that Brian is listed among them.

Founder Marc Dann and Managing Partners Brian Flick and Javier Merino are pleased to announce that DannLaw has acquired the Zingarelli Law Office, one of the Cincinnati area’s most highly respected consumer and small business bankruptcy law firms.

Founder Marc Dann and Managing Partners Brian Flick and Javier Merino are pleased to announce that DannLaw has acquired the Zingarelli Law Office, one of the Cincinnati area’s most highly respected consumer and small business bankruptcy law firms.

A recent federal appeals court decision may spell “relief” for Americans buried under private student loan debt held by Navient. In a unanimous decision, a three-judge panel of the Court of Appeals for the Fifth Circuit held that Navient private student loans ARE dischargeable in bankruptcy.

A recent federal appeals court decision may spell “relief” for Americans buried under private student loan debt held by Navient. In a unanimous decision, a three-judge panel of the Court of Appeals for the Fifth Circuit held that Navient private student loans ARE dischargeable in bankruptcy.