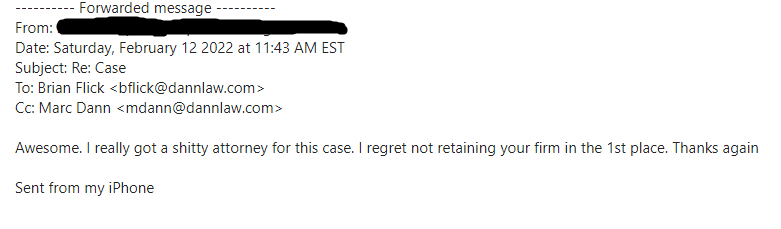

We love receiving shout-outs from our clients—even from those who took a little while to become our clients.

We love receiving shout-outs from our clients—even from those who took a little while to become our clients. From: xxxx

From: xxxx

Sent from my iPhone

DannLaw

Sent from my iPhone

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

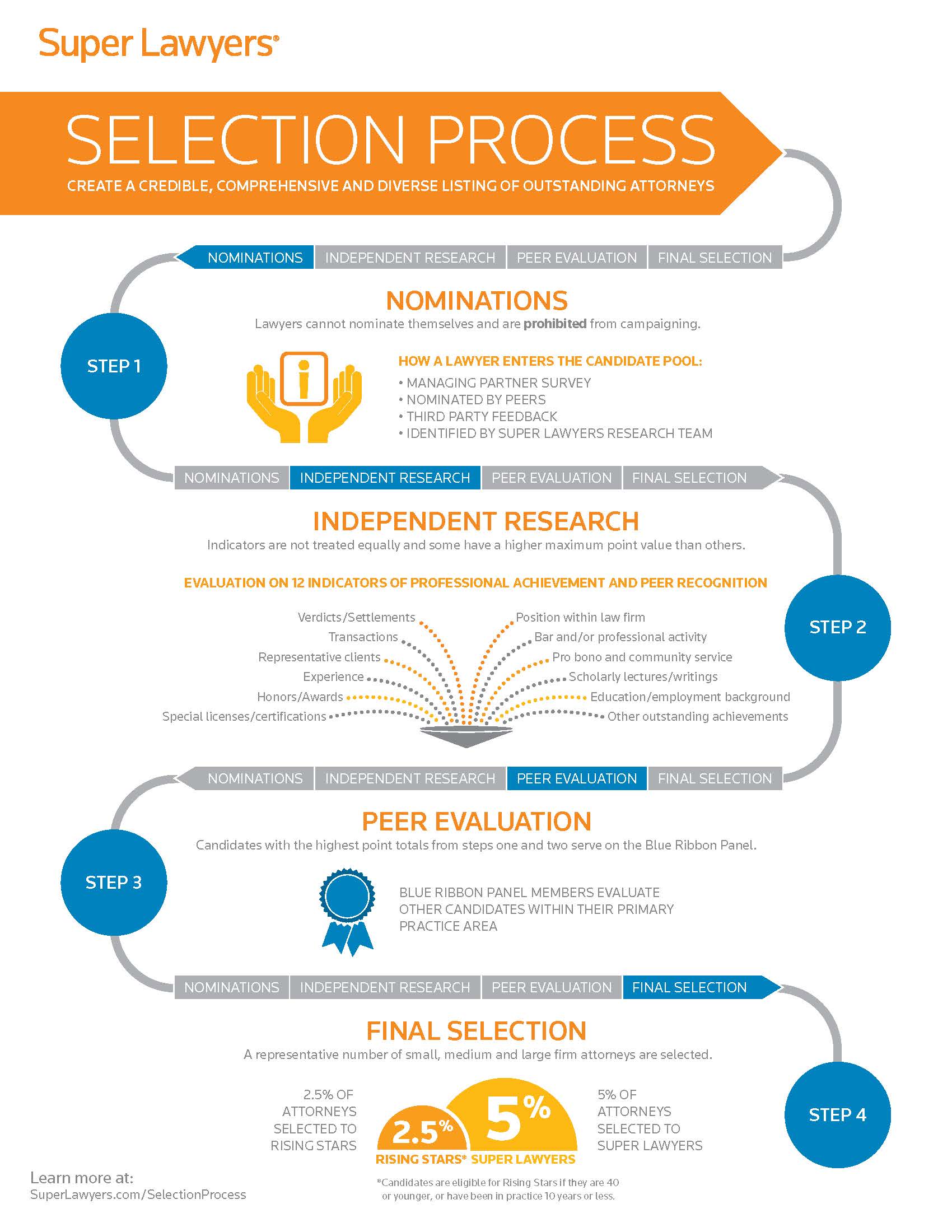

One of America’s most prestigious attorney rating services has just confirmed what his colleagues at DannLaw and the thousands of clients he has represented have long known: Brian Flick is a “SuperLawyer” in the field of consumer law. Super Lawyers selects attorneys using a patented multi-phase process that combines peer nominations and evaluations with independent research. Each candidate is evaluated on 12 indicators of professional achievement. Those who score highest then undergo a “blue ribbon” peer review by practice area. Only the highest-rated attorneys make the Super Lawyer list for each state and the designation is reserved for attorneys who excel in their field, contribute to their community, and abide by the highest professional and ethical standards. We are extremely proud that Brian is listed among them.

One of America’s most prestigious attorney rating services has just confirmed what his colleagues at DannLaw and the thousands of clients he has represented have long known: Brian Flick is a “SuperLawyer” in the field of consumer law. Super Lawyers selects attorneys using a patented multi-phase process that combines peer nominations and evaluations with independent research. Each candidate is evaluated on 12 indicators of professional achievement. Those who score highest then undergo a “blue ribbon” peer review by practice area. Only the highest-rated attorneys make the Super Lawyer list for each state and the designation is reserved for attorneys who excel in their field, contribute to their community, and abide by the highest professional and ethical standards. We are extremely proud that Brian is listed among them.

A lot has happened since we issued our first COVID-19 on March 13. In our tenth update we’ll take a look at recent developments, discuss impending challenges and opportunities, issue a couple warnings, and dispense some sage advice…

A lot has happened since we issued our first COVID-19 on March 13. In our tenth update we’ll take a look at recent developments, discuss impending challenges and opportunities, issue a couple warnings, and dispense some sage advice…

The moratorium on foreclosures imposed at the beginning of the COVID-19 crisis are coming to an end in some Ohio counties and will lapse for federally backed mortgages at the end of August. That means sheriff’s sales will resume soon.

The moratorium on foreclosures imposed at the beginning of the COVID-19 crisis are coming to an end in some Ohio counties and will lapse for federally backed mortgages at the end of August. That means sheriff’s sales will resume soon. Today it is estimated that more than 8 million Americans, including tens of thousands of Ohioans, are behind on their rent payments and may soon be evicted from their homes. This number could rise substantially when the CARES Act’s Pandemic Unemployment Insurance payments sunset at the end of July.

Today it is estimated that more than 8 million Americans, including tens of thousands of Ohioans, are behind on their rent payments and may soon be evicted from their homes. This number could rise substantially when the CARES Act’s Pandemic Unemployment Insurance payments sunset at the end of July. Finally, I would like to extend a personal invitation for you to join me on August 5 for the premiere of “The Con,” a four-part series about the 2008 fraud and corruption-fueled collapse of America’s housing market. I’m both proud and humbled to say the series highlights the steps I took as Ohio Attorney General and at DannLaw to hold those responsible for the crisis that led to 10,000,000 families losing their homes accountable for their actions. The series provides a lesson for the risks we face as we hurtle toward a pandemic-related recession.

Finally, I would like to extend a personal invitation for you to join me on August 5 for the premiere of “The Con,” a four-part series about the 2008 fraud and corruption-fueled collapse of America’s housing market. I’m both proud and humbled to say the series highlights the steps I took as Ohio Attorney General and at DannLaw to hold those responsible for the crisis that led to 10,000,000 families losing their homes accountable for their actions. The series provides a lesson for the risks we face as we hurtle toward a pandemic-related recession.