Spring is celebrated as a time for renewal. Here at DannLaw, we’re marking the beginning of the season by renewing our commitment to seeking and securing justice for consumers who have been ripped off by credit card companies, banks and retailers, homeowners abused by mortgage lenders and servicers, and victims of identity theft and other cybercrimes resulting from data breaches.

That commitment, along with our knowledge of the law, experience, expertise, and ability to develop and utilize highly effective, innovative legal strategies have made DannLaw a consumer protection powerhouse people trust to safeguard their families, their homes, and their family’s future.

Building upon that and assisting more clients than ever before are our primary goals for 2024. Here’s a look on how we plan to achieve them…

DannLaw’s Forced Arbitration Practice Group battles for consumers trapped in an unfair system

Fueled by a series of Supreme Court decisions handed down over the past 40 years, forced arbitration clauses have been adopted by tens of thousands of companies that provide a seemingly limitless array of goods and services.

This has not exactly been a positive development for consumers. Shennan Kavanagh, the director of litigation at the National Consumer Law Center (NCLC) explains why:

“Forced arbitration robs consumers of their basic Seventh Amendment right to access the courts. These fine print traps allow predatory lenders, fraudsters, unscrupulous banks, and other repeat offenders to escape accountability by depriving consumers of choice and forcing disputes into closed-door, biased proceedings where consumers rarely win.”

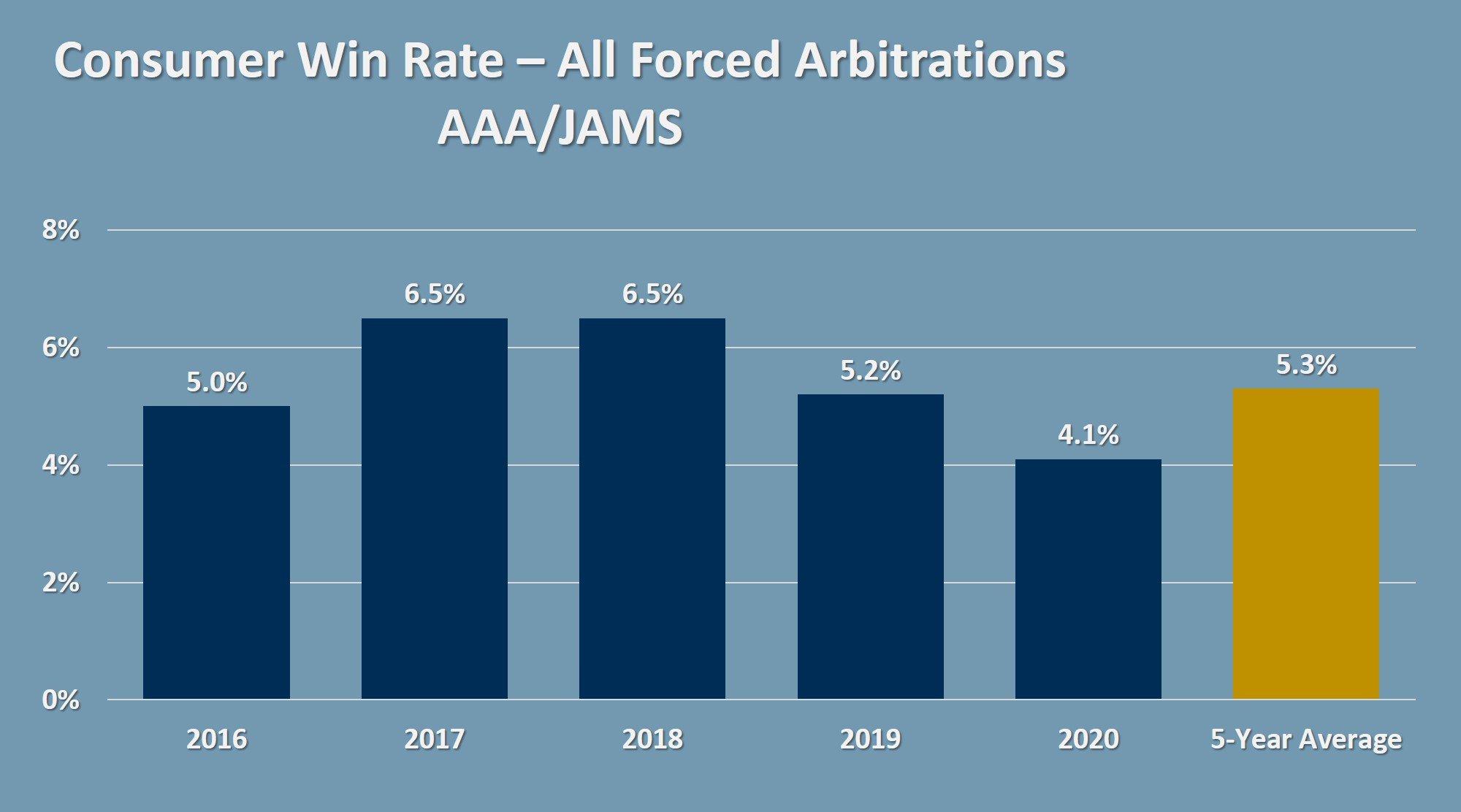

By the way, “rarely” is an understatement. According to NCLC attorney Lauren Saunders, consumers who take on companies alone lose 96% of the time.

To make matters worse, a recent study released by NCLC revealed that the vast majority of Americans have no idea what a forced arbitration clause is or does or that they unwittingly agreed to clauses buried in the fine print of contracts they clicked “yes” to online or physically signed.

That lack of knowledge can have an extremely high price tag, a fact that doesn’t hit consumers until they become embroiled in a dispute with a company and discover they have no path to justice or reasonable opportunity to recover what they are owed.

The inequities in the system cry out for reform. That is why DannLaw has joined the NCLC and other consumer advocates in calling on Congress and the Consumer Financial Protection Bureau (CFPB) to end the forced arbitration reign of terror. To date, both have refused to act.

In reaction to their inexcusable inaction, DannLaw has formed a Forced Arbitration Practice Group led by attorneys Alisa Adams and Kurt Jones who have extensive experience pursuing and winning forced arbitration claims. Alissa, Kurt, and the Group’s talented paralegals are ready, willing, and more than able to take on banks, financial services firms, and any company that is using forced arbitration to prey upon, rip off, or exploit their customers.

In reaction to their inexcusable inaction, DannLaw has formed a Forced Arbitration Practice Group led by attorneys Alisa Adams and Kurt Jones who have extensive experience pursuing and winning forced arbitration claims. Alissa, Kurt, and the Group’s talented paralegals are ready, willing, and more than able to take on banks, financial services firms, and any company that is using forced arbitration to prey upon, rip off, or exploit their customers.

If you or someone you know is a victim of forced arbitration, click here to arrange a free consultation with our Forced Arbitration team.

We are also available to co-counsel with attorneys who now represent clients with forced arbitration claims. To learn more about collaborating with us or to refer a client to us, please click here.

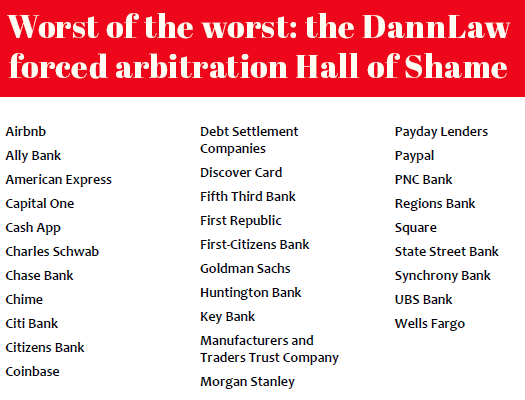

The companies and industries that have been inducted into the DannLaw Forced Arbitration Hall of Shame are among the worst abusers of the process, but they are not alone. As we noted above, thousands of other providers of goods and services use it to exploit consumers. We are prepared to battle them all.

Consumer Class Action Cases

In addition to helping our clients win forced arbitration cases, DannLaw regularly files suit on behalf of individual and groups of consumers whose claims are not subject to the unfair process.

We are currently litigating a number of class action suits in courts across the nation, and we will continue to seek justice and just compensation via the courts when that is the appropriate course of action. Here is a brief overview of some of the most interesting and consequential cases we are currently pursuing:

Financial Services Wells Fargo

It should come as no surprise to anyone that we have once again filed class action suits against Wells Fargo. Despite having paid more than $27 billion in fines since 2000, Wells remains a serious serial abuser of its customers and other consumers. \The cases against Wells involve:

It should come as no surprise to anyone that we have once again filed class action suits against Wells Fargo. Despite having paid more than $27 billion in fines since 2000, Wells remains a serious serial abuser of its customers and other consumers. \The cases against Wells involve:

Mortgage Discrimination. We allege that during the time interest rates were low, Wells denied loans to applicants who were members of minority groups at a much higher rate than other lenders.

Adding services to customer accounts without authorization. We have filed a series of class action suits alleging that Wells made millions of dollars by adding services including credit protection, supplemental hospital insurance, life and disability Insurance and others to consumers’ accounts without authorization or permission. If you recently received a letter from Wells apologizing for this conduct, we would like to hear from you. Please click here to arrange a free consultation that will enable us to determine if you are entitled to financial compensation from the company.

Financial Services: Bank of America

![]() We recently filed suit in North Carolina alleging that Bank of America opened unauthorized consumer accounts. If BOA opened an account in your name without your consent or permission, please click here to share your story with us. Like people who have been victimized by Wells, you may be eligible for financial compensation.

We recently filed suit in North Carolina alleging that Bank of America opened unauthorized consumer accounts. If BOA opened an account in your name without your consent or permission, please click here to share your story with us. Like people who have been victimized by Wells, you may be eligible for financial compensation.

Retailers: Dollar General

Despite being exposed in media reports like this one featuring DannLaw founder Marc Dann, Dollar General continues to charge higher prices at the register than are posted on shelves. We are now pursuing cases in New York, New Jersey and Oklahoma, but believe the company is engaging in the practice in other states. If this has happened to you at Dollar General or another store click here to tell us your story

Despite being exposed in media reports like this one featuring DannLaw founder Marc Dann, Dollar General continues to charge higher prices at the register than are posted on shelves. We are now pursuing cases in New York, New Jersey and Oklahoma, but believe the company is engaging in the practice in other states. If this has happened to you at Dollar General or another store click here to tell us your story

Retailers: Walmart

We are investigating reports that Walmart is treating customers who use two forms of payment unfairly when they are due a refund. If this has happened to you, please let us know.

Data Breaches

Data breaches that enable cyberthieves to steal and misuse victims’ sensitive and confidential information is a growing problem in the U.S. That is why we are expanding our Data Privacy and Security Practice Group and working with the legal community to develop strategies that will ensure we can pursue and secure justice and just compensation for those put at risk when corporations, government agencies, and other entities fail to protect the personal data in their possession. As part of that effort, I am pleased to report that I was recently invited to serve on the prestigious Sedona Conference Data and Privacy Liability Working Group which is working to address challenging questions related to legal liability and damages.

Data breaches that enable cyberthieves to steal and misuse victims’ sensitive and confidential information is a growing problem in the U.S. That is why we are expanding our Data Privacy and Security Practice Group and working with the legal community to develop strategies that will ensure we can pursue and secure justice and just compensation for those put at risk when corporations, government agencies, and other entities fail to protect the personal data in their possession. As part of that effort, I am pleased to report that I was recently invited to serve on the prestigious Sedona Conference Data and Privacy Liability Working Group which is working to address challenging questions related to legal liability and damages.

You should be aware that health care companies and insurers have become a prime target for hackers and cyber criminals, a fact underscored by the class action suits we recently filed against Merch Health and Optimum Health.

If you have been or are ever notified that your personal data including but not limited to your driver’s license, social security, credit card and other account numbers, confidential health or medical records, or other identifying information has been hacked, stolen, or compromised, please contact our data privacy team. immediately so we can begin protecting you, your family, and your future. Do not delay, every moment your data is exposed increases the chances it will be misused.

Automobile and Motorcycle dealerships:

We regularly file class action suits against car, truck, and motorcycle dealers that add unauthorized products or services to vehicles, misrepresent the amount of the sale, and/or add hidden and opaque charges like “Documentary Fees” to sales agreements.

We have secured multiple multi-million-dollar awards for classes of auto purchasers and we will continue to actively and aggressively pursue claims on behalf of consumers who have been cheated or abused. If you are troubled or suspicious about something related to your vehcile purchase contact us today to arrange a no-cost, no-obligation consultation.

Foreclosure Defense and Mortgage Servicing Litigation Update

DannLaw began by representing borrowers and homeowners who were in or about to be in foreclosure. Today, after helping thousands of people save their homes and their financial futures, stopping foreclosures and negotiating loan modifications continue to be a primary focus of our practice—and needed as much as ever.

That is because Ohio and New Jersey lead the nation in foreclosures, due in part to a surge in attempts by debt buyers to collect “zombie mortgages”— debts that homeowners thought were forgiven or satisfied long ago but still exist.

The key to our ability to save a home is timing: the earlier we get involved, the more we can do to battle mortgage lenders and servicers who engage in unethical or illegal activities like dual tracking—promising to modify a loan while moving ahead with a foreclosure action.

If you are in or are facing the threat of foreclosure DannLaw will utilize the tested, highly effective legal strategy that has helped thousands of families just like yours.

First, our experienced foreclosure defense team will aggressively defend and foreclosure action that has been filed,

Second, we will identify, document, and pursue claims you may have against your mortgage servicer for dual tracking, misapplying payments, failing to pay taxes or insurances, and other abuses, and,

Third, the members of our talented mortgage modification team will use their expertise to work out an agreement with your mortgage company that will enable you to stay in your home.

Remember, time is of the essence. Every minute you wait brings you one step closer to losing your home, do don’t delay, click here to contact DannLaw’s Foreclosure Defense team today.

Thanks for taking the time to read our Spring 2024 update and, as always, DannLaw is here to help you.

Marc

The federal government’s foreclosure moratorium ended on July 31, 2021. Under new rules issued by the Consumer Financial Protection Bureau, foreclosure actions may proceed if the borrower:

The federal government’s foreclosure moratorium ended on July 31, 2021. Under new rules issued by the Consumer Financial Protection Bureau, foreclosure actions may proceed if the borrower: A lot has happened since we issued our first COVID-19 on March 13. In our tenth update we’ll take a look at recent developments, discuss impending challenges and opportunities, issue a couple warnings, and dispense some sage advice…

A lot has happened since we issued our first COVID-19 on March 13. In our tenth update we’ll take a look at recent developments, discuss impending challenges and opportunities, issue a couple warnings, and dispense some sage advice… The moratorium on foreclosures imposed at the beginning of the COVID-19 crisis are coming to an end in some Ohio counties and will lapse for federally backed mortgages at the end of August. That means sheriff’s sales will resume soon.

The moratorium on foreclosures imposed at the beginning of the COVID-19 crisis are coming to an end in some Ohio counties and will lapse for federally backed mortgages at the end of August. That means sheriff’s sales will resume soon. Today it is estimated that more than 8 million Americans, including tens of thousands of Ohioans, are behind on their rent payments and may soon be evicted from their homes. This number could rise substantially when the CARES Act’s Pandemic Unemployment Insurance payments sunset at the end of July.

Today it is estimated that more than 8 million Americans, including tens of thousands of Ohioans, are behind on their rent payments and may soon be evicted from their homes. This number could rise substantially when the CARES Act’s Pandemic Unemployment Insurance payments sunset at the end of July. Finally, I would like to extend a personal invitation for you to join me on August 5 for the premiere of “The Con,” a four-part series about the 2008 fraud and corruption-fueled collapse of America’s housing market. I’m both proud and humbled to say the series highlights the steps I took as Ohio Attorney General and at DannLaw to hold those responsible for the crisis that led to 10,000,000 families losing their homes accountable for their actions. The series provides a lesson for the risks we face as we hurtle toward a pandemic-related recession.

Finally, I would like to extend a personal invitation for you to join me on August 5 for the premiere of “The Con,” a four-part series about the 2008 fraud and corruption-fueled collapse of America’s housing market. I’m both proud and humbled to say the series highlights the steps I took as Ohio Attorney General and at DannLaw to hold those responsible for the crisis that led to 10,000,000 families losing their homes accountable for their actions. The series provides a lesson for the risks we face as we hurtle toward a pandemic-related recession.