COLUMBUS, OH — Former Ohio Attorney General Marc Dann and former State Representative Jeffrey A. Crossman announced today that they will challenge the legality of using $600 million from Ohio’s Unclaimed Funds Trust (UFT) to finance a new stadium for the Cleveland Browns if the scheme is included in the Fiscal Year 2026/2027 biennial budget and signed into law.

COLUMBUS, OH — Former Ohio Attorney General Marc Dann and former State Representative Jeffrey A. Crossman announced today that they will challenge the legality of using $600 million from Ohio’s Unclaimed Funds Trust (UFT) to finance a new stadium for the Cleveland Browns if the scheme is included in the Fiscal Year 2026/2027 biennial budget and signed into law.

Dann and Crossman said they have drafted and will immediately file a class action lawsuit in Franklin County Common Pleas Court on behalf of three Cuyahoga County residents and all others with funds held in the UFT if the General Assembly and Governor Mike DeWine move forward with what the attorneys say is an “unconscionable, unconstitutional, and blatantly illegal confiscation of Ohioans’ private property .” View/download the draft complaint here: Browns Stadium Complaint

The draft complaint asserts that the State of Ohio intends to confiscate Ohioans’ “unclaimed funds” and divert them from their intended purpose—to be held and preserved for the benefit of the rightful owners—to finance the construction of a private sports stadium for the Cleveland Browns and further alleges that the raid on the UFT:

- Violates the Takings Clause set forth in Article V of the U.S. Constitution which says in pertinent part that: “No person shall be deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation.”

- Violates the Due Process Clause of the 14th Amendment which says “No State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any State deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws.

- Violates Article I, Section 19 of the Ohio Constitution which protects private property from being taken for private use or without just compensation.

- Represents a breach of the state’s Fiduciary Duty to serve as a custodian of the funds in the UFC under the provisions of ORC 169. 01

“The majority in the General Assembly and the Governor may think it’s acceptable to pick the pockets of Ohio’s working families to reward billionaire Jimmy Haslam for his huge political contributions, but we think it’s fundamentally wrong. That is why we’ll be standing at the courthouse door ready to file this lawsuit when and if this unprecedented abuse of the public trust actually becomes law,” Dann said.

“The Ohio Supreme Court has been crystal clear: unclaimed funds are not state property-it’s private property.,” Crossman commented. “This case is about protecting Ohioans’ constitutional rights and stopping the legislature from liquidating private property and turning it into a billionaire’s building fund. Ohioans shouldn’t have to race the clock to reclaim what’s already theirs.”

In addition to the legal arguments and settled case law protecting private property, Dann and Crossman cite a skeptical report issued by the non-partisan Legislative Service Commission in April 2025 that concluded the following:

“The academic literature on publicly funded sports stadiums is vast, covering many decades, sports, states and municipalities…The overwhelming conclusion from this body of research is that there are little to no tangible impacts of sports teams and facilities on local economic activity. A second conclusion is that the level of government subsidies given for the construction of facilities far exceeds any observed economic benefits when they do exist.” View the LSC report here: LSC_Stadium_Analysis_Redacted

“The law is unambiguous: before the government can take someone’s private property, there must be a public use for the taking. Here, there’s no public use — this is just a payout to a billionaire,” Crossman said. “If the legislature plans to fund luxury developments for the wealthy, they should find a legal way that doesn’t involve violating the fundamental property rights of Ohioans. They need to go back to the drawing board or, better yet, tell this billionaire to pay for it himself.”

For additional information contact Jeffrey A. Crossman: [email protected]; Marc E. Dann: [email protected], or phone 330-651-3131.

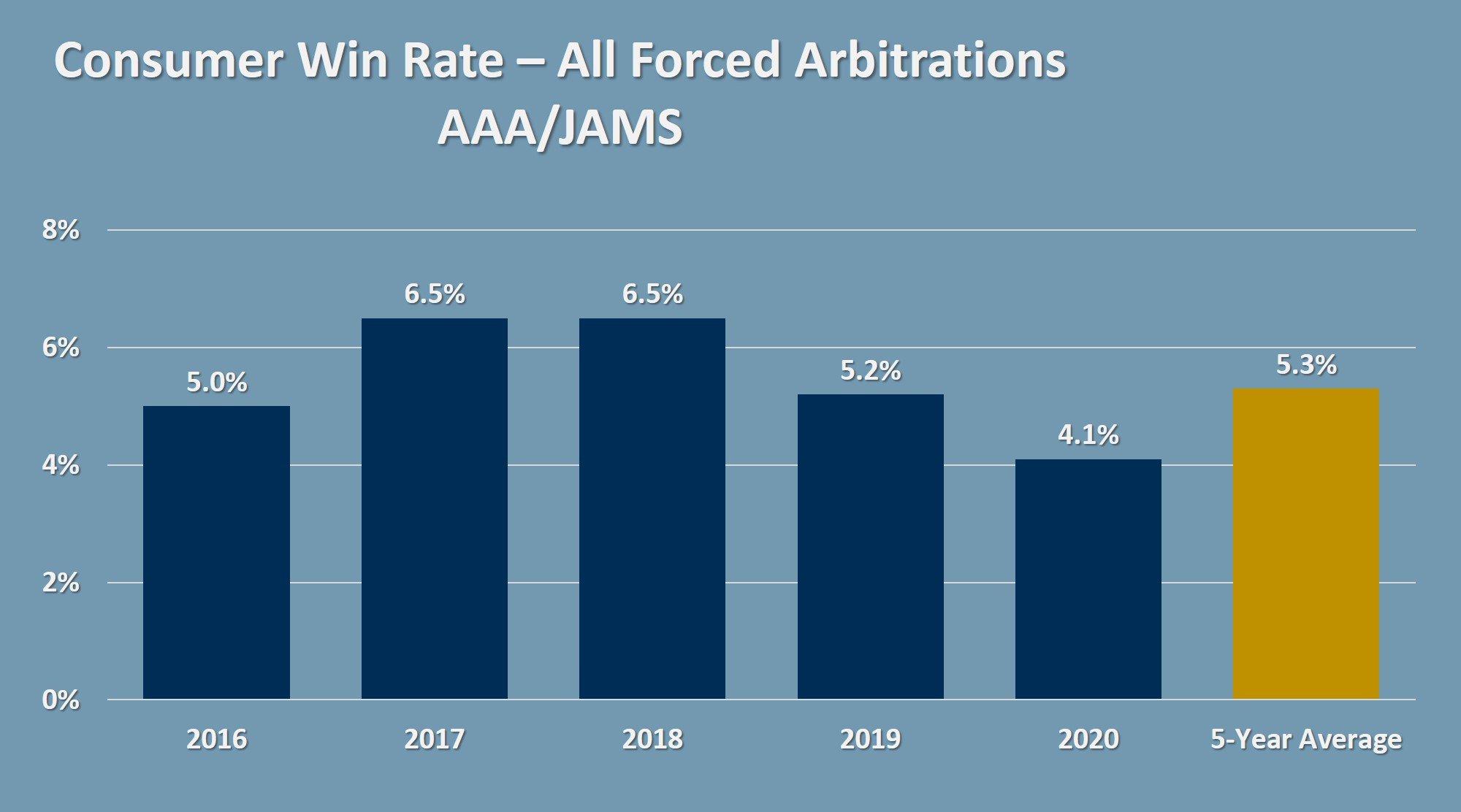

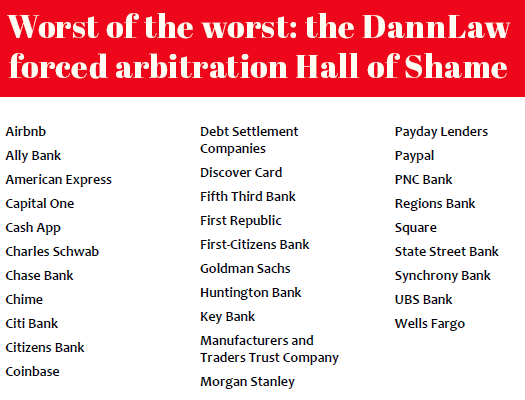

In reaction to their inexcusable inaction, DannLaw has formed a Forced Arbitration Practice Group led by attorneys Alisa Adams and Kurt Jones who have extensive experience pursuing and winning forced arbitration claims. Alissa, Kurt, and the Group’s talented paralegals are ready, willing, and more than able to take on banks, financial services firms, and any company that is using forced arbitration to prey upon, rip off, or exploit their customers.

In reaction to their inexcusable inaction, DannLaw has formed a Forced Arbitration Practice Group led by attorneys Alisa Adams and Kurt Jones who have extensive experience pursuing and winning forced arbitration claims. Alissa, Kurt, and the Group’s talented paralegals are ready, willing, and more than able to take on banks, financial services firms, and any company that is using forced arbitration to prey upon, rip off, or exploit their customers. It should come as no surprise to anyone that we have once again filed class action suits against Wells Fargo. Despite having paid more than

It should come as no surprise to anyone that we have once again filed class action suits against Wells Fargo. Despite having paid more than  Despite being exposed in media reports like this

Despite being exposed in media reports like this  Data breaches that enable cyberthieves to steal and misuse victims’ sensitive and confidential information is a growing problem in the U.S. That is why we are expanding our Data Privacy and Security Practice Group and working with the legal community to develop strategies that will ensure we can pursue and secure justice and just compensation for those put at risk when corporations, government agencies, and other entities fail to protect the personal data in their possession. As part of that effort, I am pleased to report that I was recently invited to serve on the prestigious

Data breaches that enable cyberthieves to steal and misuse victims’ sensitive and confidential information is a growing problem in the U.S. That is why we are expanding our Data Privacy and Security Practice Group and working with the legal community to develop strategies that will ensure we can pursue and secure justice and just compensation for those put at risk when corporations, government agencies, and other entities fail to protect the personal data in their possession. As part of that effort, I am pleased to report that I was recently invited to serve on the prestigious

If you received a postcard regarding the Madyda v. BMV case, it is because you are one of the people who paid a fee to have your driver’s licensed laminated by a deputy registrar between 2018 and 2020, even though the deputy registrars were not performing the service.

If you received a postcard regarding the Madyda v. BMV case, it is because you are one of the people who paid a fee to have your driver’s licensed laminated by a deputy registrar between 2018 and 2020, even though the deputy registrars were not performing the service.

Jeff brings more than two decades of legal experience to Dann Law. During his career, he has represented a variety of clients in complex matters, successfully resolving disputes for both individuals and businesses ranging from small startups to national corporations. Jeff has served as an associate with a prominent national law firm, as in-house legal counsel for multiple national companies, and recently served two terms as a member of the Ohio House of Representatives where he gained invaluable experience in public policy, government, and changes made to the legal system. The sum of Jeff’s experience has given him a unique perspective and a deep understanding of the legal landscape, which he leverages to achieve the best outcomes for his clients.

Jeff brings more than two decades of legal experience to Dann Law. During his career, he has represented a variety of clients in complex matters, successfully resolving disputes for both individuals and businesses ranging from small startups to national corporations. Jeff has served as an associate with a prominent national law firm, as in-house legal counsel for multiple national companies, and recently served two terms as a member of the Ohio House of Representatives where he gained invaluable experience in public policy, government, and changes made to the legal system. The sum of Jeff’s experience has given him a unique perspective and a deep understanding of the legal landscape, which he leverages to achieve the best outcomes for his clients. Foreclosure Defense

Foreclosure Defense