Scoundrels, Scams, and Cheats…

The DannLaw Consumer Watch Database and Forum

Created by Congress in 2010 as part of the Dodd-Frank Act, the Consumer Financial Protection Bureau (CFPB) has injected accountability, transparency, and reform into America’s financial markets. Not surprisingly, the banks, mortgage lenders, credit card companies, credit reporting bureaus, student loan companies and other entities the CFPB was empowered to regulate opposed its formation and, along with the Republicans who do their bidding, have repeatedly attempted to destroy it. For six years the agency withstood withering attacks.

During that time, it investigated and took enforcement action against hundreds of companies, shined a glaring spotlight on scams, scoundrels, and cheats, established a consumer complaint database that enabled the public to report bad actors and industry abuses, all while securing $12 billion in refunds and canceled debts for nearly 30 million consumers.

By any measure, Richard Cordray, the CFPB’s first director, and his staff did impressive work that began to make the financial services industry more consumer-friendly.

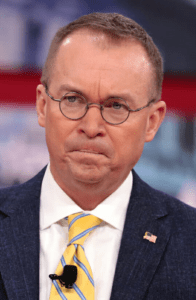

That explains why the Trump administration moved swiftly to gut the agency by forcing Cordray to resign and replacing him with former Republican Congressman Mick Mulvaney, a vehement and vociferous critic of the CFPB from its inception. Predictably, Mulvaney, who accepted tens of thousands of dollars in campaign contributions from the financial firms during his years in Congress, has done everything in his power to gut the Bureau.

His most recent assault against consumers was launched on April 25 when he told attendees at a conference of the American Bankers Association (ABA) that he planned to hide the information in the CFPB’s consumer complaint database from the public and the media. Established in 2012, the database, which contains more than 1,000,000 complaints lodged against financial firms, has become a critically important resource for Americans who want to avoid being cheated or scammed and regulators who want to hold cheaters and scammers accountable. It’s also become a major source of embarrassment for Equifax, Wells Fargo and other companies that have been the subject of thousands of complaints in recent years.

While Mulvaney is prohibited by law from shutting down the database entirely—consumers will still be able to report abuses and scams—only CFPB personnel will be able to view them. “I don’t see anything [that says] I have to run a Yelp for financial services sponsored by the federal government,” Mulvaney told appreciative finance industry lobbyists and executives who filled the room at the ABA session.

Consumer advocates like Karl Frisch, the executive director of the consumer advocacy group Allied Progress, disagree. “Daylight is a great disinfectant and the American people have a right to know when tens of thousands of their fellow citizens are complaining about a financial institution.”

We’re with Mr. Frisch. We believe the American public owns and must have access to the reports in the CFPB’s possession. So we’ve downloaded all the information currently on the CFPB’s servers and placed it in our new, searchable DannLaw Consumer Watch Database. And we’ll constantly update the records by lodging Freedom of Information Act requests for the new complaints that are lodged each month. If Mulvaney doesn’t give us the information voluntarily, we’re prepared to go to court and force him to hand it over. In short, we’re going to do everything in our power to blow up his plan to keep consumers and regulators in the dark.

Along with enabling users to search reports by company and industry, our Scoundrels, Scams, and Cheats page will track the “Top 10” villains, feature a consumer horror story of the month, and provide a link to the CFPB’s consumer complaint form–a form we’re certain Mulvaney will attempt to bury in an obscure section of the CFPB website.

We’re making the database available free of charge because at DannLaw protecting consumers isn’t just our business, it’s our calling. If you or someone you know has been scammed or cheated by a bank, mortgage lender, credit card company, student loan servicer, or other financial firm, contact us right away to arrange a free consultation. You can set up an appointment by calling the DannLaw office near you or clicking on the “schedule consultation” button in our contact form. We’re always available to discuss and evaluate your situation and provide sound advice on how we can use federal and state consumer protection laws to secure justice for you and your family.