On Tuesday, April 27, the Consumer Financial Protection Bureau announced that Mr. Cooper/Nationstar has been withdrawing multiple mortgage payments from the bank accounts of hundreds of thousands of consumers without authorization.

On Tuesday, April 27, the Consumer Financial Protection Bureau announced that Mr. Cooper/Nationstar has been withdrawing multiple mortgage payments from the bank accounts of hundreds of thousands of consumers without authorization.- Checks written on affected accounts may be returned NSF.

- Automatic withdrawals from the account for auto loans, utilities, and other consumer debts may be denied.

- Banks may charge large, multiple overdraft fees.

- Credit scores will be negatively impacted by late or denied payments.

Important notice for anyone who received a letter from a lodging chain regarding the TravelClick date breach: Don’t delay. Protect yourself and your family. Contact DannLaw TODAY!

Important notice for anyone who received a letter from a lodging chain regarding the TravelClick date breach: Don’t delay. Protect yourself and your family. Contact DannLaw TODAY!

A lot has changed since we posted our last update. A new president is in the White House, mortgage forbearance programs and foreclosure moratoriums have been extended by the federal government, a $1.9 trillion stimulus package is working its way through Congress, millions of Americans have been vaccinated against the coronavirus and the entire U.S. population may be inoculated by early summer.

A lot has changed since we posted our last update. A new president is in the White House, mortgage forbearance programs and foreclosure moratoriums have been extended by the federal government, a $1.9 trillion stimulus package is working its way through Congress, millions of Americans have been vaccinated against the coronavirus and the entire U.S. population may be inoculated by early summer.

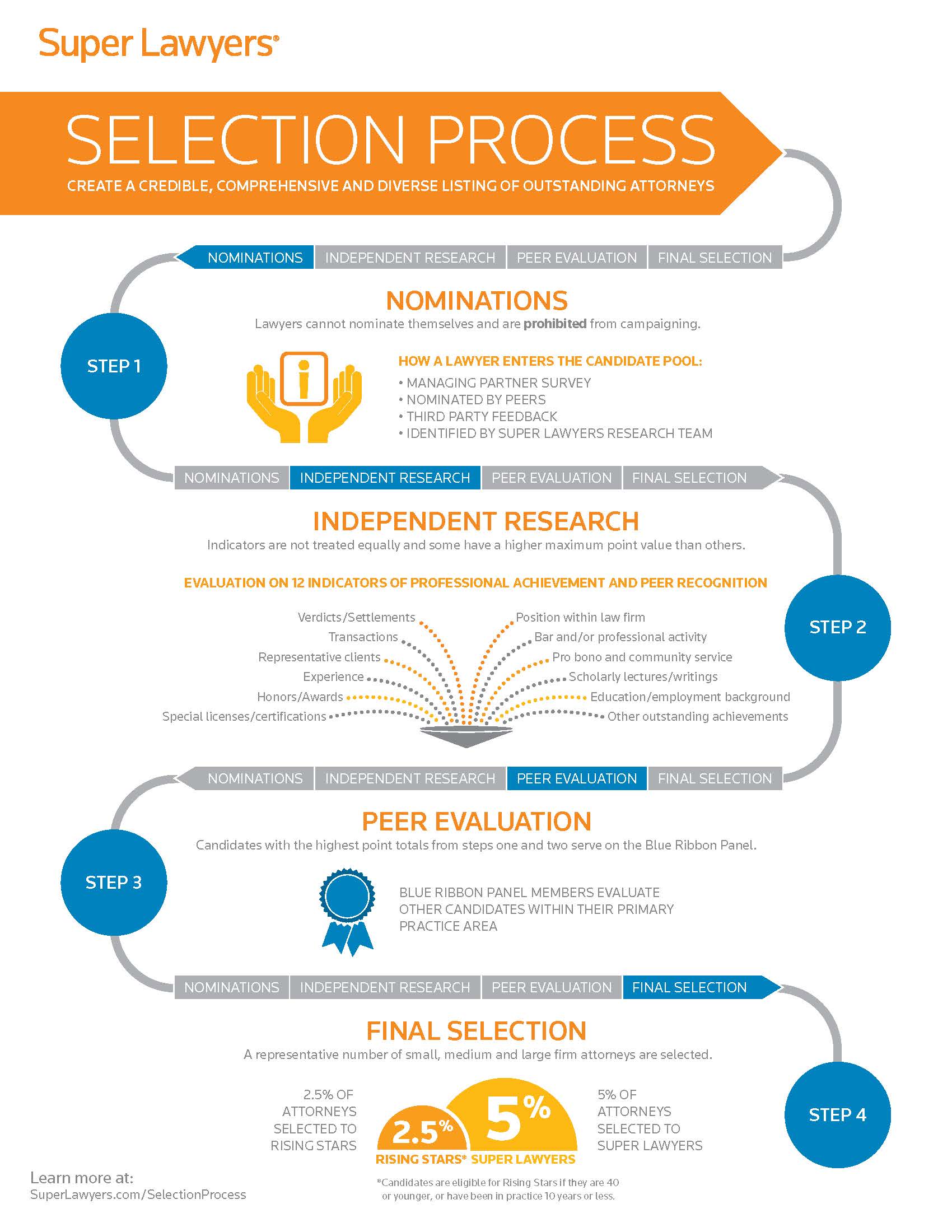

One of America’s most prestigious attorney rating services has just confirmed what his colleagues at DannLaw and the thousands of clients he has represented have long known: Brian Flick is a “SuperLawyer” in the field of consumer law. Super Lawyers selects attorneys using a patented multi-phase process that combines peer nominations and evaluations with independent research. Each candidate is evaluated on 12 indicators of professional achievement. Those who score highest then undergo a “blue ribbon” peer review by practice area. Only the highest-rated attorneys make the Super Lawyer list for each state and the designation is reserved for attorneys who excel in their field, contribute to their community, and abide by the highest professional and ethical standards. We are extremely proud that Brian is listed among them.

One of America’s most prestigious attorney rating services has just confirmed what his colleagues at DannLaw and the thousands of clients he has represented have long known: Brian Flick is a “SuperLawyer” in the field of consumer law. Super Lawyers selects attorneys using a patented multi-phase process that combines peer nominations and evaluations with independent research. Each candidate is evaluated on 12 indicators of professional achievement. Those who score highest then undergo a “blue ribbon” peer review by practice area. Only the highest-rated attorneys make the Super Lawyer list for each state and the designation is reserved for attorneys who excel in their field, contribute to their community, and abide by the highest professional and ethical standards. We are extremely proud that Brian is listed among them.