In a recent article posted on Columbia Law School’s Blue Sky Blog, Jeff Sovern argues that businesses should not be able to use the Federal Arbitration Act (FAA) to harm consumers. We agree. This flaw in the law costs American families tens of millions of dollars each year. That’s why DannLaw has been fighting for real reform of the FAA including urging the Consumer Financial Protection Bureau to issue a new rule that would block the use of arbitration clauses in consumer financial contracts. Unfortunately, until the CFPB or Congress acts, consumers will continue to be victimized by greedy corporations.

Whether you’re an attorney battling on behalf of clients or a consumer who has been ripped off by a mortgage lender, credit card company, or retailer, contact the consumer arbitration experts at DannLaw. We’re ready to help you fight and win. To learn more complete our contact form or call 330-294-3226.

We’ve posted Mr. Sovern’s CLS Blue Sky blog post below. To read a version with footnotes click here.

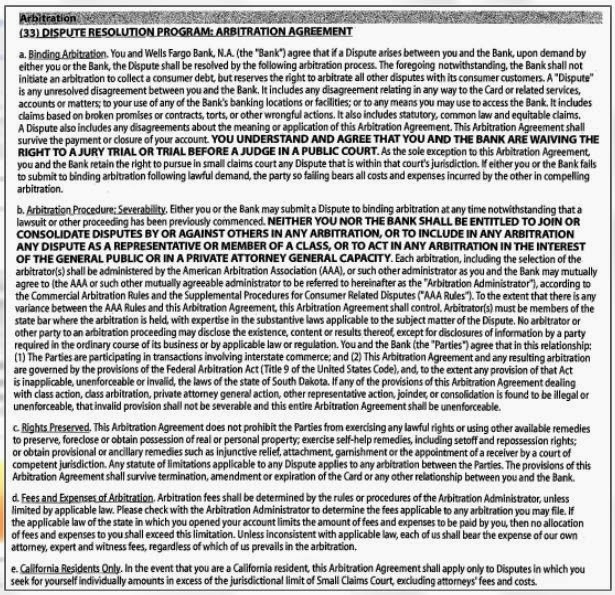

Consumer protection laws face a fundamental enforcement issue: Because consumer claims are typically for small amounts, and litigation is expensive, it rarely makes economic sense for consumers to litigate their claims individually. Partly to deal with this problem, lawmakers created class actions so the cost of litigation could be shared among many claims. But businesses have used the Federal Arbitration Act against consumers, inserting into agreements arbitration clauses that block consumer class actions. The U. S. Supreme Court has ruled these clauses are valid.[1] As a result, few consumers assert claims subject to these contracts unless a substantial amount of money is at issue.

This leads to two unfortunate outcomes. First, in many situations, merchants employing arbitration clauses need not fear that they will face private enforcement of consumer protection laws and so are insufficiently deterred from engaging in misconduct that might otherwise lead to liability. Second, consumers lack an effective means to secure compensation unless they suffer huge losses. The problem is worsened by the fact that consumers cannot understand arbitration clauses and so surrender their rights to litigate in court without realizing that they are doing so.

In a new book chapter, I argue that Congress should amend the FAA to exclude consumer claims from the FAA’s coverage until a dispute has arisen. Otherwise, the Consumer Financial Protection Bureau (“CFPB”) should use its rule-making power to limit the use of arbitration clauses in consumer financial contracts.

Arbitration and Claim Suppression

Multiple studies show that few consumers commence arbitration claims unless substantial sums are at issue. [2]Arbitration clauses’ claim-suppression effect was illustrated colorfully by one advocacy group when it observed that in many years more American consumers are struck by lightning than win a monetary award in arbitration.[3]

Consumer products and services companies are keenly aware that arbitration clauses insulate them from liability. One lawyer defending against class actions described arbitration clauses as a “silver bullet” for defeating consumer cases,[4] while another acknowledged that a “claim that is $162 – an individual claim – is not one that any rational litigant would litigate.”[5] In Judge Richard Posner’s words: “The realistic alternative to a class action is not 17 million individual suits, but zero individual suits, as only a lunatic or a fanatic sues for $30.”[6]

Arbitration and Consent

Arbitration derives its legitimacy from consent. As the Supreme Court has noted, “[a]rbitration under the [FAA] is a matter of consent . . . .”[7] But whether consumers genuinely agree to arbitration is debatable.

Research demonstrates that consumers cannot understand arbitration clauses or their impact. Thus, an empirical study of consumer understanding of an arbitration clause in a credit card contract found that less than 9 percent of the respondents realized both that the contract included an arbitration clause and that it blocked them from suing in court.[8] Despite that contract’s class action waiver, four times as many respondents thought they could still participate in a class action as recognized that by agreeing to the contract they would surrender their right to join a class action. Even when respondents were told to assume they had agreed to a contract barring them from joining in a class action, less than a third realized they were foreclosed from doing so. Just one respondent in 16 realized both that (1) the contract they had been shown would prevent them from joining a class action, and (2) as a general matter, class action waivers block participation in class actions. When consumers can neither recognize that they are waiving the right to participate in a class action nor that such a waiver would be given effect, it is difficult to justify the claim that they have consented.

A CFPB telephone survey found that a majority of its respondents believed they could join a class action despite having agreed to a contract that included a class action waiver.[9] Similarly, only one consumer in 14 understood that an arbitration clause would block them from proceeding in court. And a more recent study also found consumers do not understand arbitration clauses.[10]

At the end of the day, if consent – the source of arbitration’s legitimacy – means no more than signing a contract that consumers cannot understand, it is hard to see arbitration as legitimate.

Efforts to Carve Out Consumer Claims From the FAA

Members of Congress have repeatedly but unsuccessfully introduced bills to amend the FAA to eliminate consumer disputes from its coverage. In the 2010 Dodd-Frank Act, Congress authorized the CFPB to regulate arbitration.[11] The CFPB issued a rule which would have barred the use of class action waivers in arbitration clauses in consumer financial contracts.[12] But Congress invoked the Congressional Review Act (“CRA”)[13] to block the CFPB’s rule from going into effect.

The CFPB should issue a different arbitration rule. The Congressional Review Act bars administrative agencies from issuing “a new rule that is substantially the same” as the rule Congress struck down.[14] That bars the bureau from producing a rule banning class action waivers. Nevertheless, that still leaves the bureau options. Indeed, consumer protection advocacy groups recently petitioned the bureau to promulgate a new rule blocking the use of arbitration clauses in consumer financial contracts. The petition differs from the CFPB’s blocked rule because the regulation it calls for would not be limited to class action waivers and because the proposed regulation would be based on lack of consumer comprehension of arbitration clauses rather than the claim-suppression effect of class action waivers.

Conclusion

Arbitration clauses have become common in consumer contracts as a device to block the filing of consumer class actions against businesses catering to consumers. Consequently, it no longer makes economic sense to assert many consumer claims, and therefore companies are insufficiently deterred from violating some consumer protection laws. Using arbitration clauses to preclude class actions lacks legitimacy because consumers do not knowingly consent to arbitration. Congress should amend the FAA to exclude consumer claims from its coverage, or, failing that, the CFPB should use its authority under the Dodd-Frank Act to protect consumers against the use of arbitration clauses in consumer financial contracts.

The U.S. Supreme Court’s decision in Seila Law v. Consumer Financial Protection Bureau marked the culmination of a years-long attack against the agency by the business community, Congressional Republicans, and the Trump administration. It also provided a major dose of “be careful what you wish for because you just might get it” for the powerful forces who have been trying to destroy the CFPB since it was created in the wake of the collapse of the nation’s housing market in 2007-2008.

The U.S. Supreme Court’s decision in Seila Law v. Consumer Financial Protection Bureau marked the culmination of a years-long attack against the agency by the business community, Congressional Republicans, and the Trump administration. It also provided a major dose of “be careful what you wish for because you just might get it” for the powerful forces who have been trying to destroy the CFPB since it was created in the wake of the collapse of the nation’s housing market in 2007-2008. aninger, the unqualified anti-consumer political hack Trump appointed to succeed Cordray can be booted out the door 30 seconds after Joe Biden is sworn into office.

aninger, the unqualified anti-consumer political hack Trump appointed to succeed Cordray can be booted out the door 30 seconds after Joe Biden is sworn into office.