Hello, happy holidays, and welcome to DannLaw COVID-19 update 12. In this edition, I’ll unwrap the details of the long-overdue stimulus package that was just passed by Congress and signed by the President.

Hello, happy holidays, and welcome to DannLaw COVID-19 update 12. In this edition, I’ll unwrap the details of the long-overdue stimulus package that was just passed by Congress and signed by the President.

While the 5,600-page bill doesn’t contain anything that would set 12 lords to leaping or qualify as tidings of great joy, it does provide some much-needed financial relief and protection for consumers, workers, and homeowners impacted by the ongoing pandemic.

Direct Payments

Like the CARES Act, the new bill funds direct payments to individuals and families. Single adults with adjusted gross incomes of up to $75,000 in 2019 will receive $600. Couples earning up to $150,000 will receive $1,200. People who earn up to $112,500 and file as “head of household” will also receive $600. The payment will increase by $600 for each child under the age of 17 in a family. People with incomes above these levels will receive a partial payment that declines by $5 for every $100 in income.

If you earned less in 2020 than 2019 and would be eligible for a payment as a result, you will be able to claim the money as a refundable credit when you file your tax return for 2020. Be on the lookout for instructions on how to request the payment when your tax forms arrive—if you don’t ask for it you won’t get it.

According to Treasury Secretary Steve Mnuchin, payments via direct deposit should start showing up in bank accounts within two weeks. If yours is being delivered via the USPS it may take much longer to arrive.

Extended Unemployment Benefits

The bill extends unemployment benefits until at least March 14, 2021, for people receiving state-level benefits as well as those who are receiving checks from the Pandemic Unemployment Assistance (PUA) program which covers the self-employed, gig workers, part-timers, and others who are typically ineligible for regular unemployment payments. Everyone who qualifies for unemployment checks will also get an additional weekly payment of $300 through March 14.

Although it is half the amount provided by the CARES Act, the extra $300 per week will be critically important for families struggling to keep their heads above water as the third wave of the pandemic washes over the U.S. and the wait for vaccines to become widely available continues.

If your benefits have run out, log onto your state’s unemployment website to see if you must do anything to receive the extended aid. According to experts, most states should automatically restart your payments, but I strongly urge you to be proactive and check for yourself.

And I know this will come as a surprise, but you will probably have to wait a few weeks for new payments to arrive.

Mortgage Forbearance

As we’ve noted in previous updates, the CARES Act provides for up to 12 months of payment suspension/forbearance for borrowers with federally-backed loans owned by Fannie Mae, Freddie Mac or insured by the FHA, VA, or the Department of Agriculture. While forbearance is a valuable tool that is helping many families remain in their homes, there are some important things to keep in mind about forbearance:

First, forbearance is not automatic—you must apply. Fannie and Freddie have not set a deadline for accepting applications but if your loan is insured by the FHA, VA, or USDA you must contact your servicer and request an initial Covid-19 forbearance on or before February 28. Click here to learn more about the Fannie/Freddie forbearance process and here for info if your mortgage is backed by the FHA, VA, or the U.S. Department of Agriculture.

Second, and I know I’ve said this numerous times, FORBEARANCE IS NOT FORGIVENESS. At some point, you will be required to make the principal, interest, and escrow payments that have been deferred. Whether you have been in forbearance for some time or intend to apply, you should consult with an experienced mortgage attorney to discuss the financial challenges you will face when forbearance ends. I invite you to contact DannLaw to arrange a free consultation so we can evaluate your situation and begin planning an exit strategy that will enable you to preserve your equity and keep your home.

Third, if you are in forbearance look closely at your monthly statement to make sure it is correct. You should also check your credit report. If your servicer is entering negative information or you notice discrepancies contact us so we can help protect you and determine if you have legal claims that may entitle you to financial compensation.

Fourth, If you haven’t been able to make payments because you lost your job or were laid-off when the COVID-19 crisis cratered the economy but are now back to work you should consider taking your loan out of forbearance before the amount of delayed interest, principal, and escrow you owe becomes unmanageable.

Foreclosure Moratoriums Extended

I’m pleased to report that Fannie Mae, Freddie Mac, the VA, FHA, and USDA have extended the moratoriums on foreclosures enacted earlier this year. Single-family homeowners with loans backed by Fannie, Freddie, or the VA are now protected from foreclosure through at least Jan. 31. The FHA moratorium will remain in effect until February 28.

In addition to the CARES Act moratorium, the governor of New Jersey issued an executive order in March that prohibits foreclosure-related evictions. Under the order, homeowners cannot be removed from a residence even if a final judgment of foreclosure has been entered and a sheriff’s sale of the property has taken place. The order will remain in effect until two months after the governor declares the COVID-19 crisis has ended. In addition, more than 150 private lenders in the state have agreed to offer relief to homeowners impacted by COVID-19. You can learn more about the programs being offered in New Jersey here.

You can find a complete list of states that have imposed foreclosure/eviction moratoriums here. Ohio is conspicuous by its absence–the state has done nothing to assist homeowners.

Unfortunately, the CARES Act forbearance and foreclosure programs do not apply to borrowers whose loans are not “government-backed.” That means unless you live in a state that has enacted protections that apply to private lenders foreclosure remains a very real threat. If you are being threatened with or are already in foreclosure, I urge you to contact DannLaw today to arrange a free consultation. We may be able to take steps to slow down the process and help you save your home.

Eviction Relief

The bill extends the CDC-ordered moratorium on evictions until January 31 and provides $25 billion that will be distributed by state and local governments to people who have fallen behind in their rent.

To receive assistance a renter’s household income for 2020 may not exceed more than 80 percent of the area median income, at least one household member must be at risk of homelessness or housing instability, and individuals must qualify for unemployment benefits or have experienced financial hardship — directly or indirectly — because of the pandemic.

We will provide details on how to apply for this critically important aid as they become available.

Student Loans

The Department of Education has extended the federal student loan relief included in the CARES Act, including zero-interest-rate forbearance and a moratorium on collection activity, until January 31. Here’s an important tip: make your payments if you can because every dollar will be used to reduce the principal on your loan. Follow my advice and you will owe considerably less when the relief programs end.

I do have bad news for people with private student loans: you don’t qualify for the relief programs. That means debt collectors can continue to pursue and torment you during the pandemic.

Renewal of Paycheck Protection Program

Most of the funding in the new stimulus package is devoted to renewing and strengthening the Paycheck Protection Program (PPP) created by the CARES Act. Unlike the original version of the PPP, the revised edition focuses on small businesses, including those with ten or fewer employees, minority-owned firms, and companies located in low-income areas. You can find more info about the restructured program here.

We will provide details of how and where to apply for the new, improved version of the PPP in the coming weeks, but I urge any and every business owner who may be eligible to explore and participate in the program.

Thanks for taking a few minutes to read DannLaw Covid-19 Update 12. As always, we are here to help homeowners and consumers so please feel free to contact us if you need help or advice.

Happy New Year to you and yours and best wishes for a great 2021.

A lot has happened since we issued our first COVID-19 on March 13. In our tenth update we’ll take a look at recent developments, discuss impending challenges and opportunities, issue a couple warnings, and dispense some sage advice…

A lot has happened since we issued our first COVID-19 on March 13. In our tenth update we’ll take a look at recent developments, discuss impending challenges and opportunities, issue a couple warnings, and dispense some sage advice…

The moratorium on foreclosures imposed at the beginning of the COVID-19 crisis are coming to an end in some Ohio counties and will lapse for federally backed mortgages at the end of August. That means sheriff’s sales will resume soon.

The moratorium on foreclosures imposed at the beginning of the COVID-19 crisis are coming to an end in some Ohio counties and will lapse for federally backed mortgages at the end of August. That means sheriff’s sales will resume soon. Today it is estimated that more than 8 million Americans, including tens of thousands of Ohioans, are behind on their rent payments and may soon be evicted from their homes. This number could rise substantially when the CARES Act’s Pandemic Unemployment Insurance payments sunset at the end of July.

Today it is estimated that more than 8 million Americans, including tens of thousands of Ohioans, are behind on their rent payments and may soon be evicted from their homes. This number could rise substantially when the CARES Act’s Pandemic Unemployment Insurance payments sunset at the end of July. Finally, I would like to extend a personal invitation for you to join me on August 5 for the premiere of “The Con,” a four-part series about the 2008 fraud and corruption-fueled collapse of America’s housing market. I’m both proud and humbled to say the series highlights the steps I took as Ohio Attorney General and at DannLaw to hold those responsible for the crisis that led to 10,000,000 families losing their homes accountable for their actions. The series provides a lesson for the risks we face as we hurtle toward a pandemic-related recession.

Finally, I would like to extend a personal invitation for you to join me on August 5 for the premiere of “The Con,” a four-part series about the 2008 fraud and corruption-fueled collapse of America’s housing market. I’m both proud and humbled to say the series highlights the steps I took as Ohio Attorney General and at DannLaw to hold those responsible for the crisis that led to 10,000,000 families losing their homes accountable for their actions. The series provides a lesson for the risks we face as we hurtle toward a pandemic-related recession.

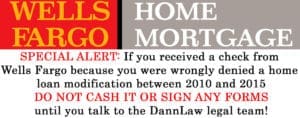

We have the honor of representing three people who lost their homes because they were unjustly denied a loan modification by Wells Fargo.

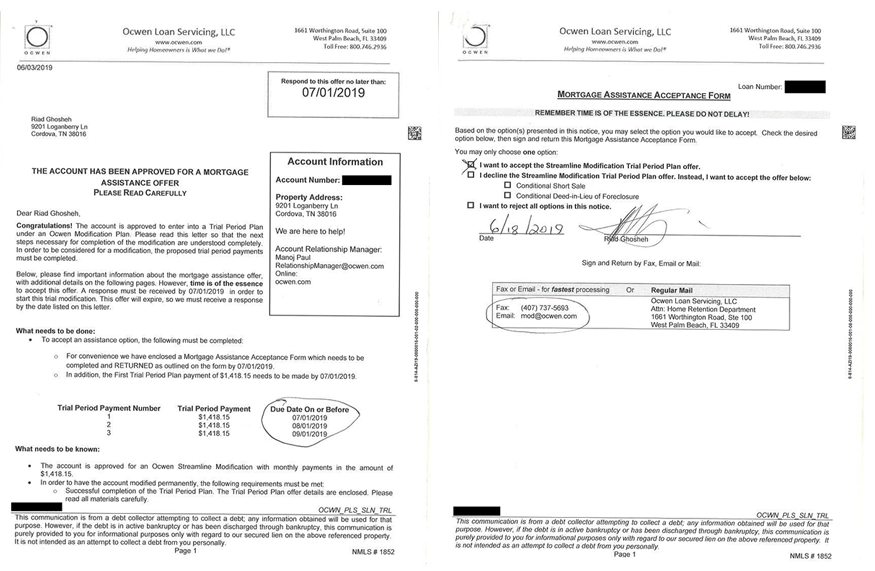

We have the honor of representing three people who lost their homes because they were unjustly denied a loan modification by Wells Fargo. Earlier this year Wells Fargo revealed in an SEC filing that a “software glitch” caused the bank to improperly deny mortgage loan modifications to 625 homeowners between 2010 and 2015. At the time, Wells said it had set aside eight million dollars to compensate borrowers impacted by the mistake, including the 400 families who lost their homes to foreclosure. Now victims of the incident are receiving checks from Wells. Attorney Marc Dann, founder and managing partner of DannLaw, is urging them to seek legal advice before accepting the money.

Earlier this year Wells Fargo revealed in an SEC filing that a “software glitch” caused the bank to improperly deny mortgage loan modifications to 625 homeowners between 2010 and 2015. At the time, Wells said it had set aside eight million dollars to compensate borrowers impacted by the mistake, including the 400 families who lost their homes to foreclosure. Now victims of the incident are receiving checks from Wells. Attorney Marc Dann, founder and managing partner of DannLaw, is urging them to seek legal advice before accepting the money.