I am pleased to announce that Brian Flick, Managing Partner of DannLaw’s Cincinnati office, has been named a “Super Lawyer Rising Star” in the area of consumer law for 2020. Only 2.5% of attorneys in Ohio are named rising stars in a particular practice area. This prestigious designation is reserved for attorneys who excel in their field, contribute to their community, and abide by the highest professional and ethical standards.

I am pleased to announce that Brian Flick, Managing Partner of DannLaw’s Cincinnati office, has been named a “Super Lawyer Rising Star” in the area of consumer law for 2020. Only 2.5% of attorneys in Ohio are named rising stars in a particular practice area. This prestigious designation is reserved for attorneys who excel in their field, contribute to their community, and abide by the highest professional and ethical standards.

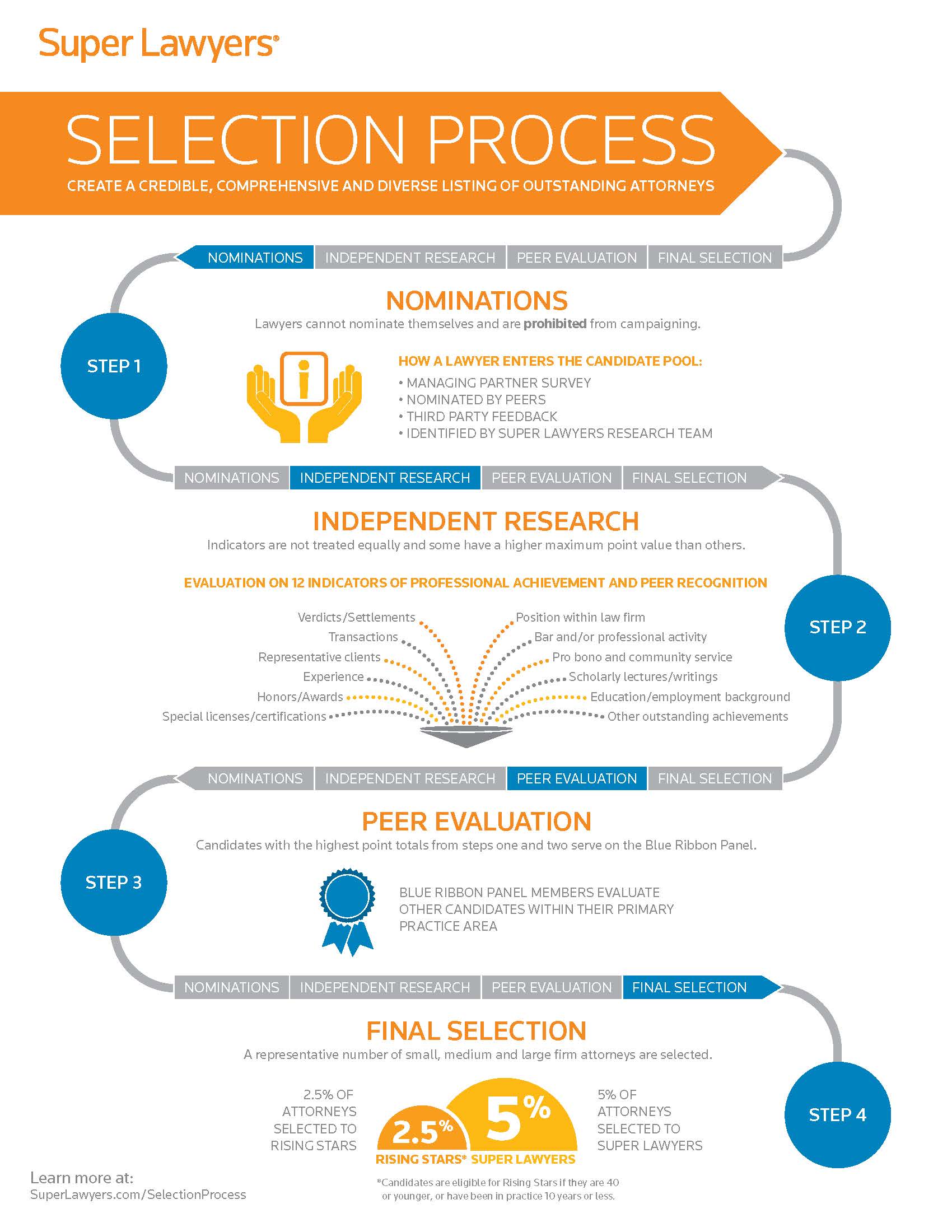

Super Lawyers selects attorneys using a patented multi-phase process that combines peer nominations and evaluations with independent research. Each candidate is evaluated on 12 indicators of professional achievement. Those who score highest then undergo a “blue ribbon” peer review by practice area. Only the highest-rated attorneys make the Super Lawyer list for each state. We are proud that Chris and Doug are among them.

Brian was previously named a Rising Star in the area of consumer bankruptcy law.

Super Lawyer Selection Process Emphasizes Peer Recognition, Accomplishment, Performance, Experience

A recent federal appeals court decision may spell “relief” for Americans buried under private student loan debt held by Navient. In a unanimous decision, a three-judge panel of the Court of Appeals for the Fifth Circuit held that Navient private student loans ARE dischargeable in bankruptcy.

A recent federal appeals court decision may spell “relief” for Americans buried under private student loan debt held by Navient. In a unanimous decision, a three-judge panel of the Court of Appeals for the Fifth Circuit held that Navient private student loans ARE dischargeable in bankruptcy. DannLaw today filed suit against the owners of the Homewood Suites by Hilton hotel located in Mahwah, New Jersey and Hilton Worldwide Holdings, Inc. for repeatedly violating both the Americans with Disabilities Act (ADA) and New Jersey’s anti-discrimination laws. The suit, filed on behalf of Erika Symmonds, alleges that the defendants twice failed to provide ADA-compliant accommodations after confirming that mobility accessible rooms were available at the Mahwah, NJ facility. The pleading in the case, which was filed today in the Federal District Court for the District of New Jersey may be viewed and downloaded here:

DannLaw today filed suit against the owners of the Homewood Suites by Hilton hotel located in Mahwah, New Jersey and Hilton Worldwide Holdings, Inc. for repeatedly violating both the Americans with Disabilities Act (ADA) and New Jersey’s anti-discrimination laws. The suit, filed on behalf of Erika Symmonds, alleges that the defendants twice failed to provide ADA-compliant accommodations after confirming that mobility accessible rooms were available at the Mahwah, NJ facility. The pleading in the case, which was filed today in the Federal District Court for the District of New Jersey may be viewed and downloaded here: The Earl Restaurant Group just announced that that cyberthieves gained access to debit and credit card information of 2,000,000 people who visited Buca di Beppo, Earl of Sandwich, Planet Hollywood, Chicken Guy, Mixology or Tequila Taqueria restaurants in the United States between May 23, 2018, and March 18, 2019.

The Earl Restaurant Group just announced that that cyberthieves gained access to debit and credit card information of 2,000,000 people who visited Buca di Beppo, Earl of Sandwich, Planet Hollywood, Chicken Guy, Mixology or Tequila Taqueria restaurants in the United States between May 23, 2018, and March 18, 2019. Growers in the Kona region of Hawaii have filed suit against the stores/online retailers listed below alleging they have been labeling and selling non-Kona coffee as Kona coffee for years.

Growers in the Kona region of Hawaii have filed suit against the stores/online retailers listed below alleging they have been labeling and selling non-Kona coffee as Kona coffee for years. The scam artists at Wells Fargo strike again. This time the bank enticed homeowners to apply for trial mortgage

The scam artists at Wells Fargo strike again. This time the bank enticed homeowners to apply for trial mortgage