If you are a former Home Savings or First Federal customer who now banks with Premier, contact us TODAY so we can protect your family’s financial future and fight for the monetary compensation you need and deserve.

If you are a former Home Savings or First Federal customer who now banks with Premier, contact us TODAY so we can protect your family’s financial future and fight for the monetary compensation you need and deserve.

The slogan “Better Together” used by officials of Home Savings Bank and First Federal Bank to characterize the merger that created Premier Bank in April 2020 will ring hollow if the new bank has violated the federal laws and rules that govern mortgage lending and servicing by engaging in these and other abusive practices:

- Failing to automatically withdraw and/or correctly credit monthly house payments to borrowers’ accounts;

- Failing to send borrowers monthly mortgage statements;

- Refusing to respond to requests for information, including loan payoff amounts, in the timeframe required by law;

- Providing false and/or inaccurate information to the major credit bureaus about the status of borrowers’ loans.

The impact of illegal acts like these can be devastating. Victimized homeowners could see their credit scores plummet by hundreds of points, be unable to refinance their homes to take advantage of low-interest rates, find it difficult to obtain a mortgage for a new home, and be denied credit or charged higher interest rates on auto loans and other types of borrowing.

That means mistakes made by Premier could cost borrowers tens of thousands of dollars—even though they did nothing wrong.

If you believe you have been abused by Premier or have questions about the bank’s actions/activities, please contact DannLaw and Marc Dann immediately by email at [email protected], calling 877-475-8100 or via the contact form on our website: dannlaw.brmcstaging.com/contact to arrange a no-cost, no-obligation consultation that will enable us to

determine if you are eligible to receive substantial monetary damages under the provisions of the Real Estate Sales Practices Act (RESPA), the Truth in Lending Act (TILA), and the Fair Debt Collection Practices Act (FDCPA).

Please contact us TODAY so we can begin protecting you, your family, and your financial future.

On Tuesday, April 27, the Consumer Financial Protection Bureau announced that Mr. Cooper/Nationstar has been withdrawing multiple mortgage payments from the bank accounts of hundreds of thousands of consumers without authorization.

On Tuesday, April 27, the Consumer Financial Protection Bureau announced that Mr. Cooper/Nationstar has been withdrawing multiple mortgage payments from the bank accounts of hundreds of thousands of consumers without authorization. Important notice for anyone who received a letter from a lodging chain regarding the TravelClick date breach: Don’t delay. Protect yourself and your family. Contact DannLaw TODAY!

Important notice for anyone who received a letter from a lodging chain regarding the TravelClick date breach: Don’t delay. Protect yourself and your family. Contact DannLaw TODAY!

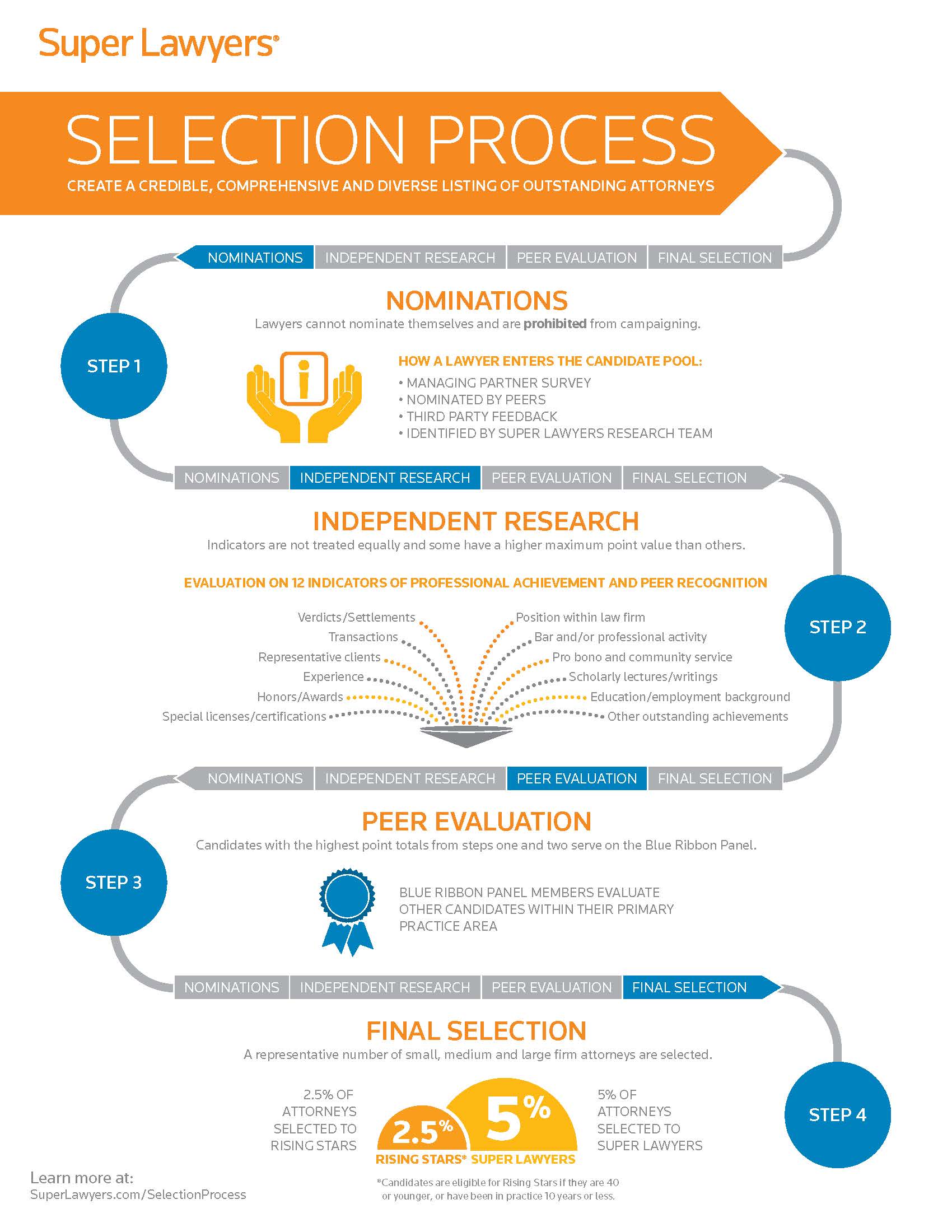

One of America’s most prestigious attorney rating services has just confirmed what his colleagues at DannLaw and the thousands of clients he has represented have long known: Brian Flick is a “SuperLawyer” in the field of consumer law. Super Lawyers selects attorneys using a patented multi-phase process that combines peer nominations and evaluations with independent research. Each candidate is evaluated on 12 indicators of professional achievement. Those who score highest then undergo a “blue ribbon” peer review by practice area. Only the highest-rated attorneys make the Super Lawyer list for each state and the designation is reserved for attorneys who excel in their field, contribute to their community, and abide by the highest professional and ethical standards. We are extremely proud that Brian is listed among them.

One of America’s most prestigious attorney rating services has just confirmed what his colleagues at DannLaw and the thousands of clients he has represented have long known: Brian Flick is a “SuperLawyer” in the field of consumer law. Super Lawyers selects attorneys using a patented multi-phase process that combines peer nominations and evaluations with independent research. Each candidate is evaluated on 12 indicators of professional achievement. Those who score highest then undergo a “blue ribbon” peer review by practice area. Only the highest-rated attorneys make the Super Lawyer list for each state and the designation is reserved for attorneys who excel in their field, contribute to their community, and abide by the highest professional and ethical standards. We are extremely proud that Brian is listed among them.