Franklin County Judge rules Governor DeWine violated Ohio law when he rejected fully federally funded Federl Pandemic Unemployment Compensation payments

In a landmark and long-awaited decision, Franklin County Common Pleas Court Judge Michael Holbrook today ordered Governor Mike DeWine and the Ohio Department of Jobs and Family Services (ODJFS) to immediately reinstate Ohio’s participation in the Federal Pandemic Unemployment Compensation (FPUC) program and take all action necessary to obtain Ohio’s share of FPUC program benefits from the United States Department of Labor (DOL). A copy of the decision is available here.

Former Ohio Attorney General Marc Dann, whose law firm, DannLaw, originally filed suit in July of 2021 on behalf of thousands of Ohioans who were denied $300 in weekly supplemental unemployment benefit payments due to Governor DeWine’s unwarranted decision to end the state’s participation in the fully-federally funded program on June 26, 2021, hailed the ruling as a major victory for his clients and the state of Ohio.

“Today, Judge Holbrook validated our contention that Governor DeWine and ODJFS were required by Ohio law to accept and distribute the FUPC payments to Ohioans devastated by COVID-19,” Dann said. “The Governor’s decision to deny federal aid to families in crisis was arbitrary and unconscionable, and illegal. It is our sincere hope that he will now honor his obligation to obey the law without delay.”

According to Dann, eligible Ohioans will receive an estimated $900,000,000 in FUPC benefits as a result of Judge Holbrook’s ruling. “The payments will both enable people still reeling from the effects of the pandemic to rebuild their lives and significantly boost the state’s economy,” he said. “We’ve never understood why the Governor would leave nearly a billion dollars sitting in an account in Washington, D.C. rather than allowing that money to flow into Ohio’s 88 cities, townships, and villages where it will fuel sales for local businesses and generate tax revenue. Aside from being cruel, refusing funds made no sense from an economic standpoint.”

“We’ve been assured the money is there, it’s far past time for the state to ask for it on behalf of citizens who desperately need it,” Dann continued.

Judge Holbrook’s Judgement Entry reads as follows:

1, Pursuant to State ex rel Candy Bowling v. Mike DeWine, 2021-Ohio-2902, FPUC is one of the “available advantages” described in R.C. 4141.43(I) that the General Assemble requires Defendants “secure” to the citizens of the State of Ohio.

2. Defendants acted in violation of R.C. 4343.41(I) when they terminated participation in the FPUC program prior to its expiration.

3. Defendants are hereby ORDERED pursuant to R.C. 4343.41(I) to take all action necessary to reinstate Ohio’s participation in the FPUC program from June 26, 2021 through its expiration; and

4. Defendants are hereby ORDERED pursuant to R.C. 4343.41(I) to take all action necessary to obtain Ohio’s share of FPUC program benefits from the United States Department of Labor.

Dann acknowledged that decision could be appealed, but noted the 10th District Court of Appeals had already ruled against the state. “The law, Judge Holbrook’s ruling, and the opinion from the 10th District Court of Appeals are crystal clear: the state is required to obtain and distribute these funds. But, as we’ve now proven multiple times, if the Governor refuses to abide by the law, we will fight and we will win,”

Over the Weekend President Trump fired Rohit Chopra the Director of the Consumer Finance Protection Bureau (CFPB) and today replaced him with Treasury Secretary (and hedge fund oligarch) Scott Bessent.

Over the Weekend President Trump fired Rohit Chopra the Director of the Consumer Finance Protection Bureau (CFPB) and today replaced him with Treasury Secretary (and hedge fund oligarch) Scott Bessent.

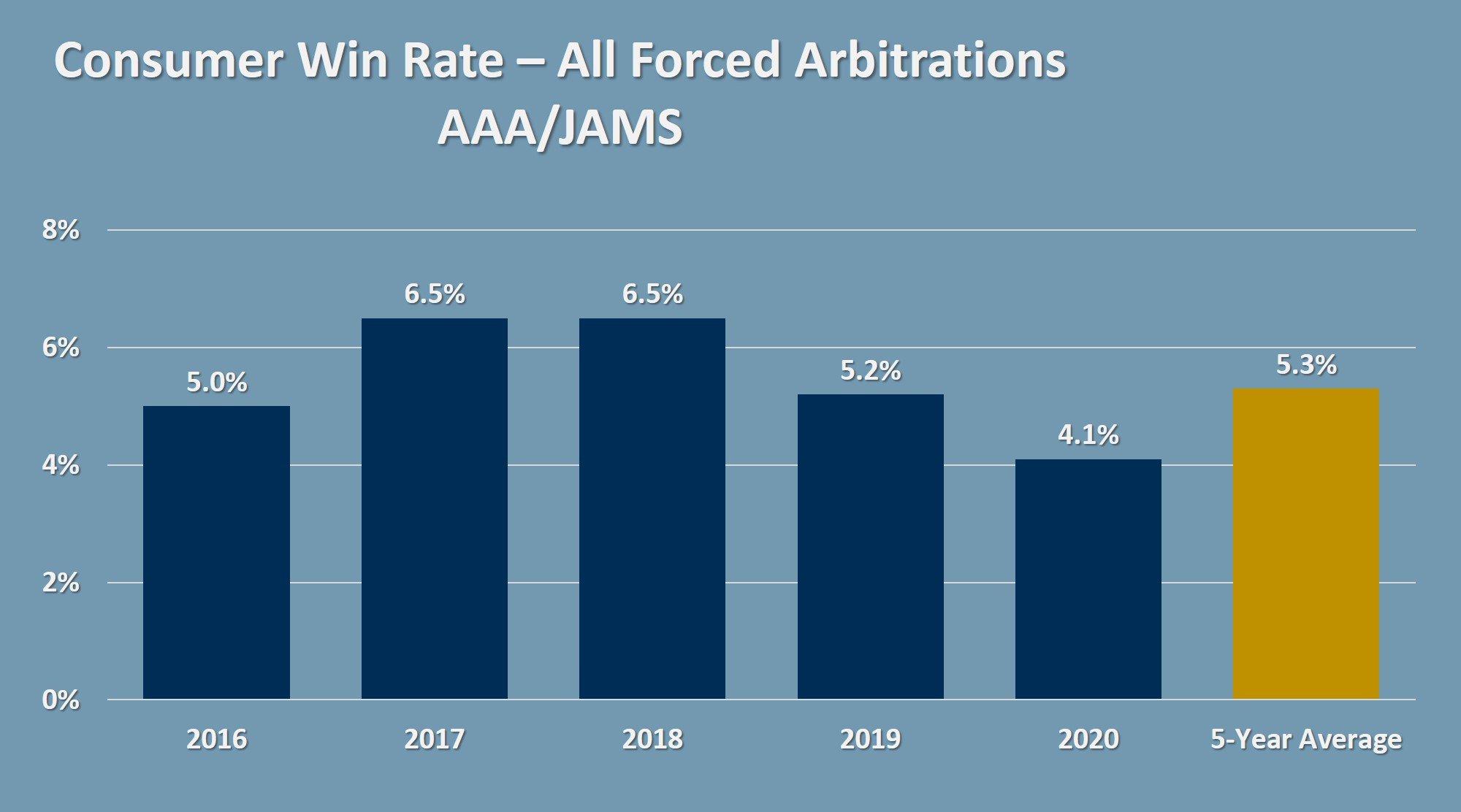

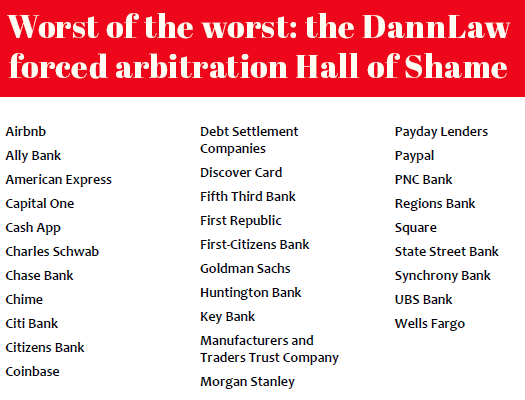

In reaction to their inexcusable inaction, DannLaw has formed a Forced Arbitration Practice Group led by attorneys Alisa Adams and Kurt Jones who have extensive experience pursuing and winning forced arbitration claims. Alissa, Kurt, and the Group’s talented paralegals are ready, willing, and more than able to take on banks, financial services firms, and any company that is using forced arbitration to prey upon, rip off, or exploit their customers.

In reaction to their inexcusable inaction, DannLaw has formed a Forced Arbitration Practice Group led by attorneys Alisa Adams and Kurt Jones who have extensive experience pursuing and winning forced arbitration claims. Alissa, Kurt, and the Group’s talented paralegals are ready, willing, and more than able to take on banks, financial services firms, and any company that is using forced arbitration to prey upon, rip off, or exploit their customers. It should come as no surprise to anyone that we have once again filed class action suits against Wells Fargo. Despite having paid more than

It should come as no surprise to anyone that we have once again filed class action suits against Wells Fargo. Despite having paid more than  Despite being exposed in media reports like this

Despite being exposed in media reports like this  Data breaches that enable cyberthieves to steal and misuse victims’ sensitive and confidential information is a growing problem in the U.S. That is why we are expanding our Data Privacy and Security Practice Group and working with the legal community to develop strategies that will ensure we can pursue and secure justice and just compensation for those put at risk when corporations, government agencies, and other entities fail to protect the personal data in their possession. As part of that effort, I am pleased to report that I was recently invited to serve on the prestigious

Data breaches that enable cyberthieves to steal and misuse victims’ sensitive and confidential information is a growing problem in the U.S. That is why we are expanding our Data Privacy and Security Practice Group and working with the legal community to develop strategies that will ensure we can pursue and secure justice and just compensation for those put at risk when corporations, government agencies, and other entities fail to protect the personal data in their possession. As part of that effort, I am pleased to report that I was recently invited to serve on the prestigious

Franklin County Common Pleas Court Judge Michael Holbrook ruled today that a class action lawsuit filed by DannLaw on behalf of Ohioans impacted by Governor Mike DeWine’s decision to terminate fully federally-funded Pandemic Unemployment Assistance (PUA) off payments in May of 2021 may continue. In a 16-page order Judge Holbrook denied Attorney General Dave Yost’s motion to dismiss the suit and said the plaintiffs had “…sufficiently plead claims for declaratory judgment, injunctive relief, and petitions for writs of mandamus. He also scheduled a status conference for Tuesday, April 9, 2024, at 1:30 PM. Judge Holbrook’s order may be viewed here:

Franklin County Common Pleas Court Judge Michael Holbrook ruled today that a class action lawsuit filed by DannLaw on behalf of Ohioans impacted by Governor Mike DeWine’s decision to terminate fully federally-funded Pandemic Unemployment Assistance (PUA) off payments in May of 2021 may continue. In a 16-page order Judge Holbrook denied Attorney General Dave Yost’s motion to dismiss the suit and said the plaintiffs had “…sufficiently plead claims for declaratory judgment, injunctive relief, and petitions for writs of mandamus. He also scheduled a status conference for Tuesday, April 9, 2024, at 1:30 PM. Judge Holbrook’s order may be viewed here: