Marc Dann and the entire DannLaw team is dedicated to protecting consumers and holding unscrupulous lenders accountable for their actions. That is why Marc is testifying against HB 182 during a hearing of the Ohio House Financial Institutions Committee on Tuesday, June 18, 2024. The hearing will be broadcast live and archived on the Ohio Channel: Ohio House Financial Institutions Committee | The Ohio Channel.

If you believe, as we do, that this legislation threatens consumers, please contact your state representative and tell them to oppose HB 182.

Marc’s testimony follows:

Chairman LaRe, Vice Chairman Pizzulli, Ranking Member Dell’Aquilla, and Members of the House Financial Institutions Committee:

I’m Marc Dann. Both as Ohio Attorney General and in private practice I’ve dedicated my career to protecting consumers from financial predators including non-bank lenders. At my firm DannLaw we have represented hundreds of working- and middle-class Ohioans who have been buried in inescapable consumer debt.

On behalf of the National Association of Consumer Advocates (NACA) and all Ohio Consumers I offer this testimony in opposition to HB 182.

House Bill 182 would harm Ohio consumers by giving non-bank, virtually unregulated consumer lending companies free reign to gouge and take advantage of Ohio consumers. In addition, the legislation will open a gaping hole that will bring the scourge of predatory payday loans back to Ohio.

Let’s remember that everyone in this room is a consumer, including the members of the committee, your staff, the lobbyists who are promoting this bill and each and every one of your constituents.

There is so much wrong with this bill that it’s hard to find a good place to start today.

But, perhaps the worst part of this bad law is the Bona Fide Error provision that will give lenders a free pass when they are caught cheating their customers.

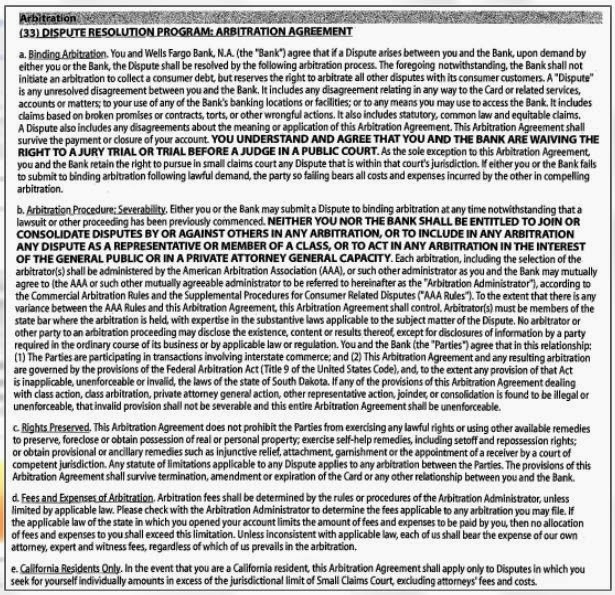

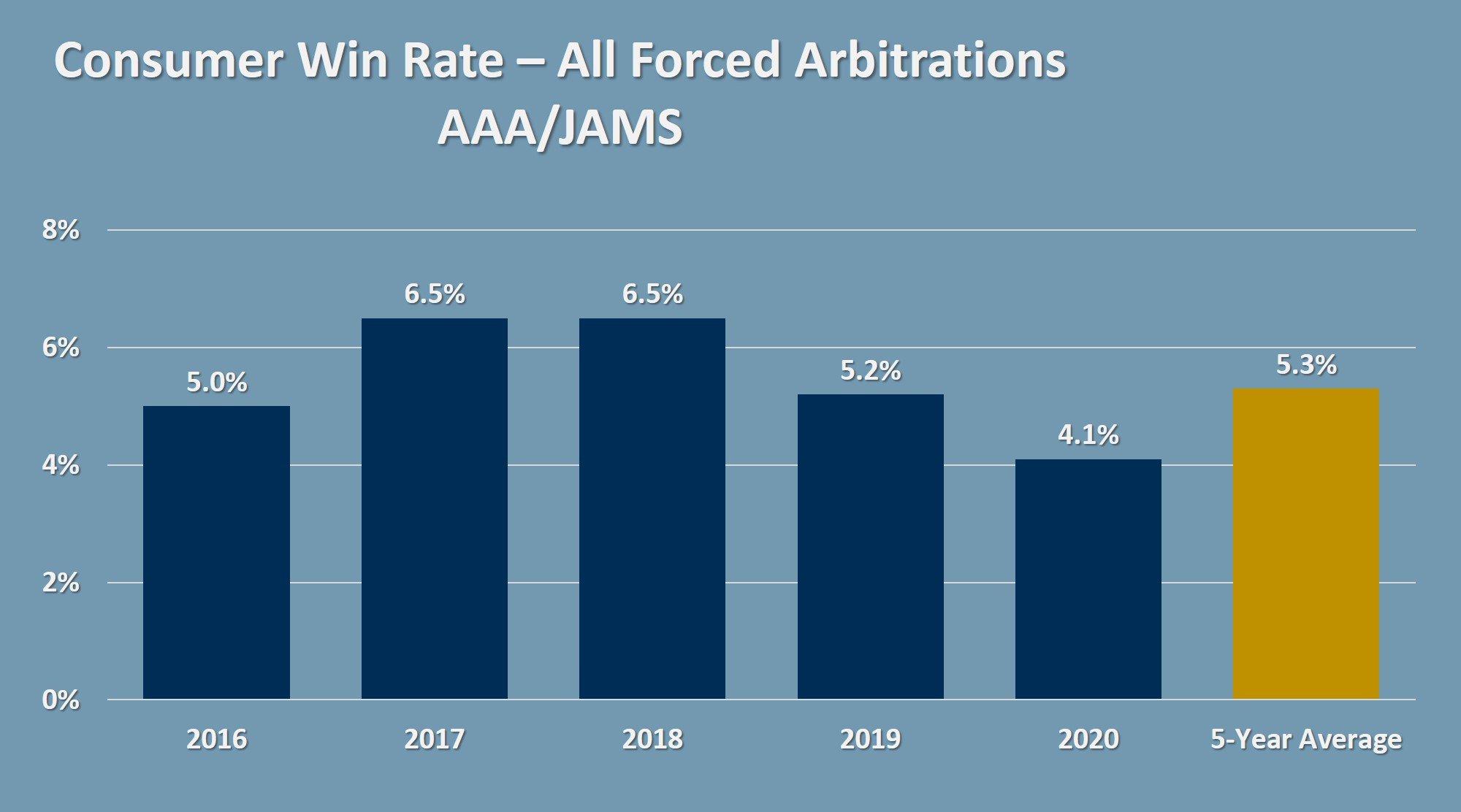

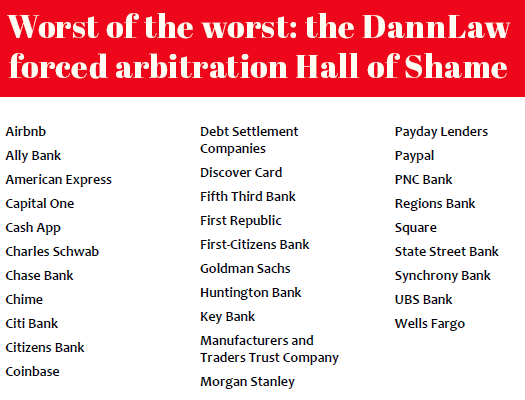

This ill-conceived “Free Pass” language creates an incentive for unscrupulous lenders to cheat their customers because they will face neither risk nor consequences for adding extra fees and costs to loans, misreporting customers’ delinquency status to credit reporting agencies, or for suing borrowers who are not actually behind on their obligations. Combine that with the fact that most of these contracts contain one sided Arbitration provisions that bar consumers suing lenders in court or bringing class action cases over these small dollar loans, and one can only conclude that HB 182 will declare open season on Ohio Borrowers. If you are determined to pass this bill, at least consider an amendment that will prevent lenders from including arbitration provisions and class action waivers in their contracts.

But that’s not the only anti-consumer provision in the proposed law. While loan sharks in the old days were more than happy to charge desperate friends and neighbors 25% “vig”, even they would be embarrassed to demand 36% interest for a short-term loan. Coupled with fees that are often assessed with these loans and language in the bill that will permit lenders to add the interest due on the loan up front and the actual cost balloons to nearly 50%. One of the best days I spent in a legislative hearing room like this was in 2018 when representatives and senators of both parties worked together to pass one of the best payday lending laws in the country, which among other things limited interest on payday loans to a more reasonable 28%. Now short-term lenders propose to gouge consumers 8% more for loans that are underwritten to be more likely to be repaid.

Allowing lenders to charge unlimited fees to refinance or renew these short-term loans is another feature of this bill that will return Ohio to the bad old days of predatory payday lending that existed prior to 2018. This is another feature that would make these loans more like pre-2018 push your friends and neighbors into an unsustainable cycle of debt that many of us thought were banished once and for all from our state.

The upfront interest provision would allow lenders to collect interest on interest when a borrower defaults on the loan. This is something that is not legal for virtually any other lender.

And a separate provision–unprecedented in lending legislation–allows lenders to collect fees and penalties first instead of applying any payments received to principal first and interest and fees second.

Finally, unlike other consumer protection laws in Ohio this proposed revision of the Short-Term Loan Act would enable lenders to charge for attorney’s fees that are not awarded by a court. That is unfair and will erect another barrier that will make it incredibly difficult for borrowers who have fallen behind to catch up on their payments.

This bill was crafted to create financial products that set up consumers to fail, default on their loan and ultimately force them into bankruptcy. While that might be good for lawyers or the lenders who charge high fees and interest that will almost certainly generate a profit for companies before consumers default, this bill does nothing to improve the lives of Ohioans or fill an actual marketplace need.

In sum, Ohio consumers would be best served and protected by maintaining current state law which provides reasonable limitations on short term lenders–not by creating an open door that will lead to the restoration of predatory payday lending in Ohio.

In reaction to their inexcusable inaction, DannLaw has formed a Forced Arbitration Practice Group led by attorneys Alisa Adams and Kurt Jones who have extensive experience pursuing and winning forced arbitration claims. Alissa, Kurt, and the Group’s talented paralegals are ready, willing, and more than able to take on banks, financial services firms, and any company that is using forced arbitration to prey upon, rip off, or exploit their customers.

In reaction to their inexcusable inaction, DannLaw has formed a Forced Arbitration Practice Group led by attorneys Alisa Adams and Kurt Jones who have extensive experience pursuing and winning forced arbitration claims. Alissa, Kurt, and the Group’s talented paralegals are ready, willing, and more than able to take on banks, financial services firms, and any company that is using forced arbitration to prey upon, rip off, or exploit their customers. It should come as no surprise to anyone that we have once again filed class action suits against Wells Fargo. Despite having paid more than

It should come as no surprise to anyone that we have once again filed class action suits against Wells Fargo. Despite having paid more than  Despite being exposed in media reports like this

Despite being exposed in media reports like this  Data breaches that enable cyberthieves to steal and misuse victims’ sensitive and confidential information is a growing problem in the U.S. That is why we are expanding our Data Privacy and Security Practice Group and working with the legal community to develop strategies that will ensure we can pursue and secure justice and just compensation for those put at risk when corporations, government agencies, and other entities fail to protect the personal data in their possession. As part of that effort, I am pleased to report that I was recently invited to serve on the prestigious

Data breaches that enable cyberthieves to steal and misuse victims’ sensitive and confidential information is a growing problem in the U.S. That is why we are expanding our Data Privacy and Security Practice Group and working with the legal community to develop strategies that will ensure we can pursue and secure justice and just compensation for those put at risk when corporations, government agencies, and other entities fail to protect the personal data in their possession. As part of that effort, I am pleased to report that I was recently invited to serve on the prestigious

Franklin County Common Pleas Court Judge Michael Holbrook ruled today that a class action lawsuit filed by DannLaw on behalf of Ohioans impacted by Governor Mike DeWine’s decision to terminate fully federally-funded Pandemic Unemployment Assistance (PUA) off payments in May of 2021 may continue. In a 16-page order Judge Holbrook denied Attorney General Dave Yost’s motion to dismiss the suit and said the plaintiffs had “…sufficiently plead claims for declaratory judgment, injunctive relief, and petitions for writs of mandamus. He also scheduled a status conference for Tuesday, April 9, 2024, at 1:30 PM. Judge Holbrook’s order may be viewed here:

Franklin County Common Pleas Court Judge Michael Holbrook ruled today that a class action lawsuit filed by DannLaw on behalf of Ohioans impacted by Governor Mike DeWine’s decision to terminate fully federally-funded Pandemic Unemployment Assistance (PUA) off payments in May of 2021 may continue. In a 16-page order Judge Holbrook denied Attorney General Dave Yost’s motion to dismiss the suit and said the plaintiffs had “…sufficiently plead claims for declaratory judgment, injunctive relief, and petitions for writs of mandamus. He also scheduled a status conference for Tuesday, April 9, 2024, at 1:30 PM. Judge Holbrook’s order may be viewed here: