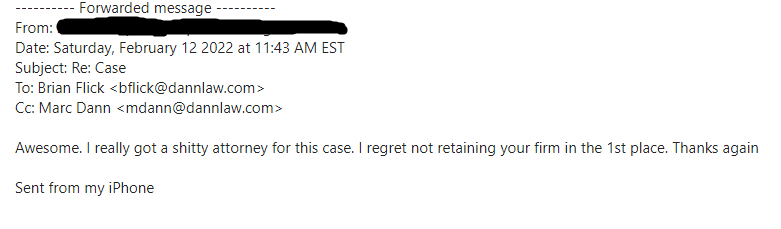

We love receiving shout-outs from our clients—even from those who took a little while to become our clients.

We love receiving shout-outs from our clients—even from those who took a little while to become our clients. From: xxxx

From: xxxx

Sent from my iPhone

DannLaw

Sent from my iPhone

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Sent from my iPhone

DannLaw

Mortgage loan servicers often provide inaccurate and/or incomplete information about the loss mitigation options available to borrowers leaving forbearance or seeking loan modifications.

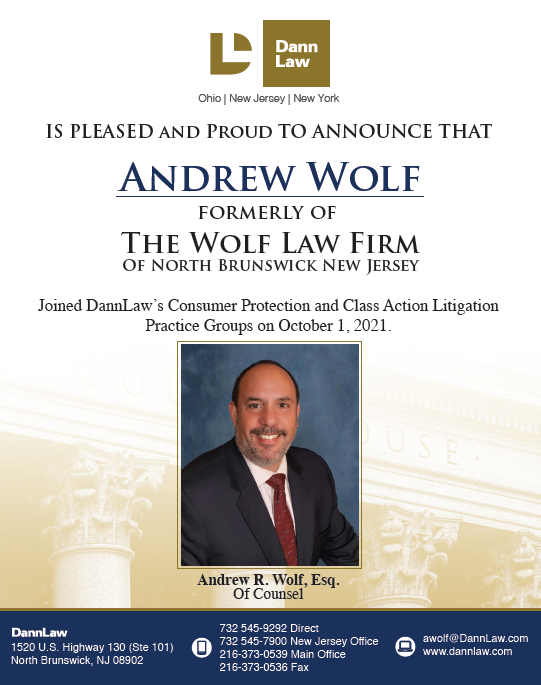

Mortgage loan servicers often provide inaccurate and/or incomplete information about the loss mitigation options available to borrowers leaving forbearance or seeking loan modifications. DannLaw founder and former Ohio Attorney General Marc Dann announced today that Attorney Andrew Wolf of North Brunswick, New Jersey has become an “Of Counsel” member of DannLaw’s Consumer Protection and Class Action Litigation Practice groups. Wolf, who has earned a reputation as one of the nation’s most effective consumer advocates will be based in DannLaw’s New Jersey/New York office.

DannLaw founder and former Ohio Attorney General Marc Dann announced today that Attorney Andrew Wolf of North Brunswick, New Jersey has become an “Of Counsel” member of DannLaw’s Consumer Protection and Class Action Litigation Practice groups. Wolf, who has earned a reputation as one of the nation’s most effective consumer advocates will be based in DannLaw’s New Jersey/New York office. An explanation of each option may be found in our

An explanation of each option may be found in our