According to the Federal Trade Commission (FTC) and the FBI, Bitcoin ATM cryptocurrency kiosks (BTMs) play an essential role in “impersonation scams” that enable cybercriminals and scam artists to steal large sums of money from unsuspecting victims. Data from the FTC reveals that fraud losses at BTMs increased tenfold from 2020 to 2023 and that the amounts stolen via the kiosks are exceptionally high. But despite the well-documented rise in BTM-fueled fraud, companies like Athena Bitcoin, Inc. which operates hundreds of terminals across the U.S., have repeatedly refused to reduce or eliminate the extreme danger they pose to vulnerable populations, especially seniors.

The consumer protection team at Dann Law now represents one of those seniors: Karen Carew, a 74-year-old resident of Belmar, New Jersey. On September 4, 2024, a criminal impersonating a Microsoft tech support telephone agent convinced her to withdraw $39,000 from her bank account and deposit it into Athena BTMs located at two area convenience stores. Her money was immediately transferred into the untraceable online account or “wallet” of the scam artist. Both he and her money then vanished.

To hold Athena and the convenience stores accountable for their role in defrauding Ms. Carew and victims of similar scams, DannLaw attorneys Henry P. Wolfe, Javier Merino, and Andrew Wolfe recently filed a class action lawsuit in the Superior Court of New Jersey against the company, its CEO Matias Golenhorn, the owners of the stores where the kiosks used to facilitate the Carew scam were located, as well as other stores in New Jersey that have permitted Athena to locate and operate kiosks on site. The complaint and supporting exhibits may be viewed and downloaded here: 2024.11.25 Carew Complaint FILED

In the complaint the attorneys note that Athena openly acknowledges its kiosks are regularly used in impersonation scams as a page on the company website titled “Avoid these Bitcoin Scams” clearly illustrates:

Scammers are looking to say and do anything to convince you of an urgent need to pay through Bitcoin, and they will often “helpfully” point out nearby ATMs where you can follow their commands.

Scam artists like Bitcoin because transactions cannot be cancelled, reversed, or otherwise refunded once made.

Athena receives numerous reports of fraud per month…

The complaint also alleges that although Athena clearly recognizes the dangers posed by its BTMs it has refused to implement effective measures that would prevent or deter the use of its terminals in impersonation scams. Why? Because doing so would reduce the considerable profit realized from every dollar inserted into its BTMs by victims of those scams.

“BTMs are specifically designed to appeal to criminals, that’s why I consider them to be the AR 15s of the financial services industry,” DannLaw founder and former Ohio Attorney General Marc Dann commented. “They serve no purpose beyond enabling scam artists to wreak havoc and destruction on innocent victims and the complete and purposeful lack of safeguards enable them to inflict pain in rapid-fire fashion and disappear instantly. As Ms. Carew learned, that’s a formula for disaster.”

In addition to facilitating the impersonation scam, the complaint states that Athena refused to turn over the $39,000 Ms. Carew deposited into the BTMs after being notified of the theft even though the stolen cash was in their possession. Their refusal is based on the company’s position that all deposited into its terminals is “irreversibly” transferred as Bitcoin to the designated wallet, even if the wallet in question belongs to a criminal who has perpetrated an impersonation scam.

DannLaw contends that Athena’s position is misleading at best for two reasons: first, because Ms. Carew’s cash was still inside the company’s BTMs when they were made aware of the theft, and, second, because the hefty fee Athena charged to facilitate the crime, $10,060.04, was not transferred to the scam artist irreversibly or otherwise.

“In essence, Ms. Carew has been ripped off twice,” Dann said. “First by the criminal who robbed her and then by Athena which could, but refuses, to return her money. While their position is reprehensible, it is not surprising. Let’s face it, thieves like Athena rarely return stolen money to its rightful owners, especially if doing so would destroy their business model. It’s clear they have no intention of doing the right thing voluntarily, so we’re more than willing to use the civil justice system to both hold them accountable and educate the public about the dangers associated with Athena BTMs.”

The suit asserts four causes of action including possession of stolen property, violations of New Jersey’s RICO statute and Consumer Fraud Act, and gross negligence and seeks monetary damages for Ms. Carew and all class members

For more information, please contact Marc Dann at 330-651-3131.

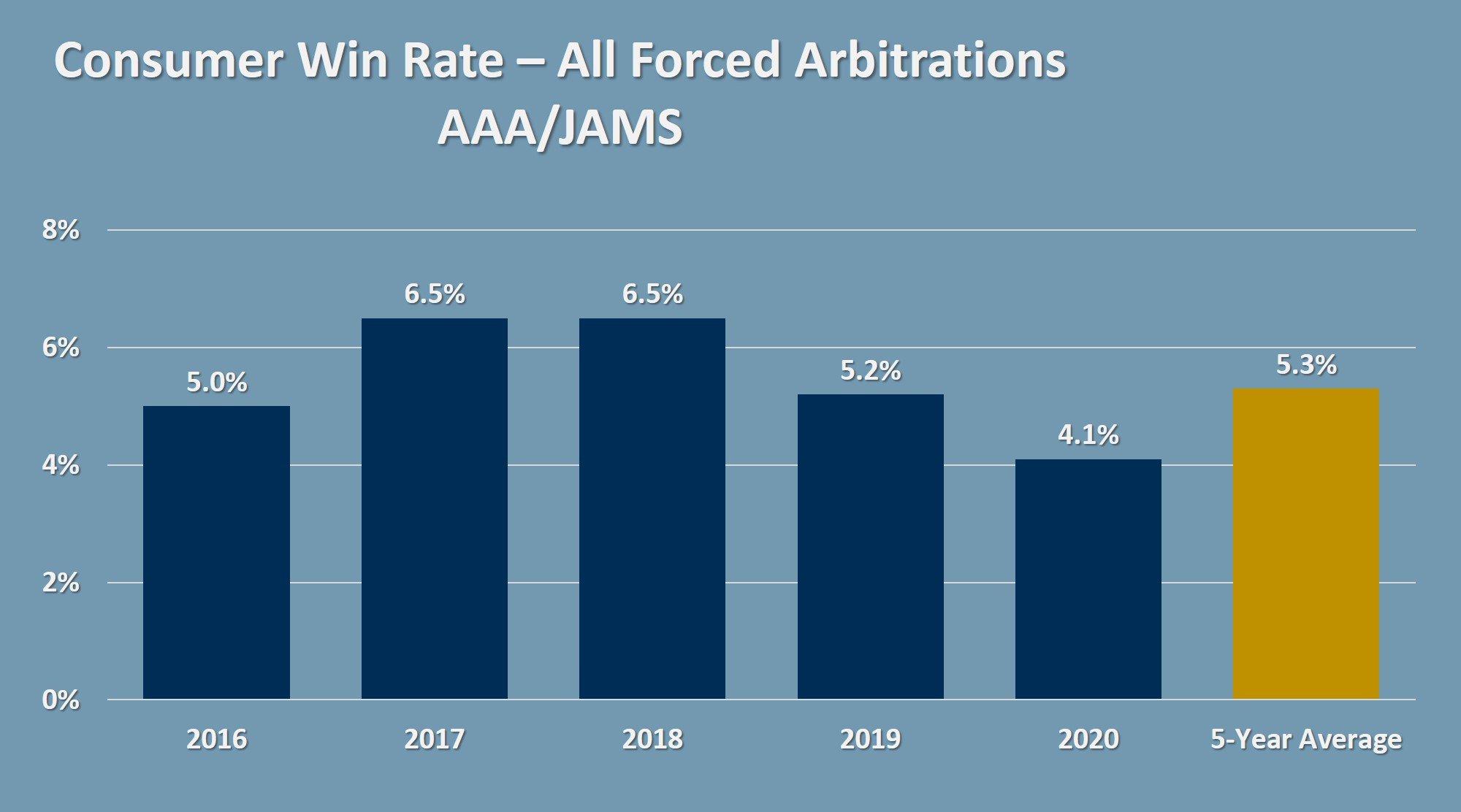

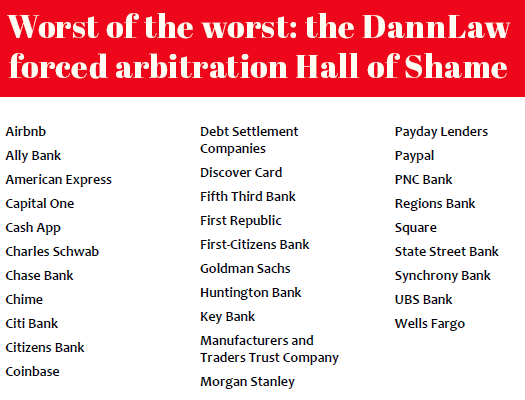

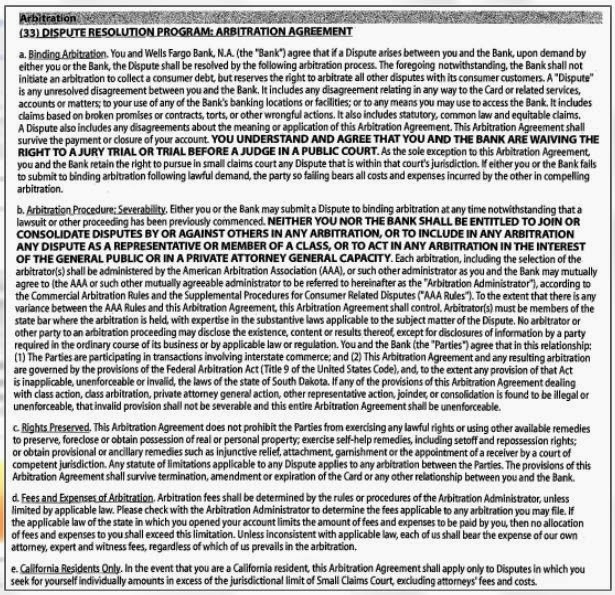

In reaction to their inexcusable inaction, DannLaw has formed a Forced Arbitration Practice Group led by attorneys Alisa Adams and Kurt Jones who have extensive experience pursuing and winning forced arbitration claims. Alissa, Kurt, and the Group’s talented paralegals are ready, willing, and more than able to take on banks, financial services firms, and any company that is using forced arbitration to prey upon, rip off, or exploit their customers.

In reaction to their inexcusable inaction, DannLaw has formed a Forced Arbitration Practice Group led by attorneys Alisa Adams and Kurt Jones who have extensive experience pursuing and winning forced arbitration claims. Alissa, Kurt, and the Group’s talented paralegals are ready, willing, and more than able to take on banks, financial services firms, and any company that is using forced arbitration to prey upon, rip off, or exploit their customers. It should come as no surprise to anyone that we have once again filed class action suits against Wells Fargo. Despite having paid more than

It should come as no surprise to anyone that we have once again filed class action suits against Wells Fargo. Despite having paid more than  Despite being exposed in media reports like this

Despite being exposed in media reports like this  Data breaches that enable cyberthieves to steal and misuse victims’ sensitive and confidential information is a growing problem in the U.S. That is why we are expanding our Data Privacy and Security Practice Group and working with the legal community to develop strategies that will ensure we can pursue and secure justice and just compensation for those put at risk when corporations, government agencies, and other entities fail to protect the personal data in their possession. As part of that effort, I am pleased to report that I was recently invited to serve on the prestigious

Data breaches that enable cyberthieves to steal and misuse victims’ sensitive and confidential information is a growing problem in the U.S. That is why we are expanding our Data Privacy and Security Practice Group and working with the legal community to develop strategies that will ensure we can pursue and secure justice and just compensation for those put at risk when corporations, government agencies, and other entities fail to protect the personal data in their possession. As part of that effort, I am pleased to report that I was recently invited to serve on the prestigious

If you received a postcard regarding the Madyda v. BMV case, it is because you are one of the people who paid a fee to have your driver’s licensed laminated by a deputy registrar between 2018 and 2020, even though the deputy registrars were not performing the service.

If you received a postcard regarding the Madyda v. BMV case, it is because you are one of the people who paid a fee to have your driver’s licensed laminated by a deputy registrar between 2018 and 2020, even though the deputy registrars were not performing the service.

Jeff brings more than two decades of legal experience to Dann Law. During his career, he has represented a variety of clients in complex matters, successfully resolving disputes for both individuals and businesses ranging from small startups to national corporations. Jeff has served as an associate with a prominent national law firm, as in-house legal counsel for multiple national companies, and recently served two terms as a member of the Ohio House of Representatives where he gained invaluable experience in public policy, government, and changes made to the legal system. The sum of Jeff’s experience has given him a unique perspective and a deep understanding of the legal landscape, which he leverages to achieve the best outcomes for his clients.

Jeff brings more than two decades of legal experience to Dann Law. During his career, he has represented a variety of clients in complex matters, successfully resolving disputes for both individuals and businesses ranging from small startups to national corporations. Jeff has served as an associate with a prominent national law firm, as in-house legal counsel for multiple national companies, and recently served two terms as a member of the Ohio House of Representatives where he gained invaluable experience in public policy, government, and changes made to the legal system. The sum of Jeff’s experience has given him a unique perspective and a deep understanding of the legal landscape, which he leverages to achieve the best outcomes for his clients. Foreclosure Defense

Foreclosure Defense