The U.S. Supreme Court’s decision in Seila Law v. Consumer Financial Protection Bureau marked the culmination of a years-long attack against the agency by the business community, Congressional Republicans, and the Trump administration. It also provided a major dose of “be careful what you wish for because you just might get it” for the powerful forces who have been trying to destroy the CFPB since it was created in the wake of the collapse of the nation’s housing market in 2007-2008.

The U.S. Supreme Court’s decision in Seila Law v. Consumer Financial Protection Bureau marked the culmination of a years-long attack against the agency by the business community, Congressional Republicans, and the Trump administration. It also provided a major dose of “be careful what you wish for because you just might get it” for the powerful forces who have been trying to destroy the CFPB since it was created in the wake of the collapse of the nation’s housing market in 2007-2008.

Precipitated by Donald Trump’s decision to fire director Richard Cordray in defiance of the statute that established the agency, the suit, filed by a firm that ran a mortgage modification scam, was expected to deal a fatal blow to the CFPB. Or at least that’s what those who lined up on the side of Seila, including the DOJ, U.S. Chamber of Commerce, the National Foundation of Independent Businesses, the Mortgage Bankers Association, and a number of entities that had been tagged by the Bureau for abusing consumers, hoped.

The Court, in a 5-4 decision dashed those hopes. Yes, the majority upheld Cordray’s firing and found that the governing structure of the agency was unconstitutional, but this sentence dealt the CFPB’s foes two staggering blows:

“The agency may therefore continue to operate, but its Director, in light of our decision, must be removable by the President at will.” You may read the entire decision and the amicus briefs here.

The first blow: the CFPB may continue to operate and, thanks to this decision, constitutional challenges to its validity are now at an end. That’s not quite what the boys at the USCOC and the NFIB were looking for when they filed their amicus briefs.

And here’s the second: Kathy Kr aninger, the unqualified anti-consumer political hack Trump appointed to succeed Cordray can be booted out the door 30 seconds after Joe Biden is sworn into office.

aninger, the unqualified anti-consumer political hack Trump appointed to succeed Cordray can be booted out the door 30 seconds after Joe Biden is sworn into office.

The ironic part of this entire affair is that the governing structure of the CFPB was specifically intended to shield the agency from politics. The GOP’s attacks have now made who will run the Bureau and whether they will use its immense power to protect consumers a perpetual issue in presidential campaigns.

Along with taking great satisfaction at seeing the business community’s attack on the CFPB blow up in their collective faces, we at DannLaw are also extremely pleased that the ruling preserves our ability to act as “private attorneys general” who can use the Real Estate Sales Practices Act (RESPA) and the Truth in Lending Act (TILA) to protect our clients and seek and secure damages from mortgage servicers and lenders who violate the law.

While little noticed, Director Cordray’s creation of a private right to action is one of the most important components of the laws and regulations enacted after the housing crisis. He, along with Senator Chris Dodd, Congressman Barney Frank, and then-professor Elizabeth Warren recognized that the failure of government regulators to exercise their oversight authority played a major role in bringing the nation and the world to the brink of a catastrophic financial meltdown. By giving private attorneys the power to use RESPA and TILA to hold bad actors accountable they created a second line of defense for homeowners, consumers, and the American economy.

At DannLaw, we’ve used that power to help hundreds of people fight off illegal foreclosures, obtain loan modifications, safeguard their assets, and hold onto their hopes and dreams. We’re truly grateful that those who sought to destroy the CFPB have instead guaranteed that we and lawyers like us across the country will be able to use the law to fight for our clients well into the future.

In fact, I’m so grateful, I think I’ll send the guys at Seila and the Trump Justice Department a thank you note today.

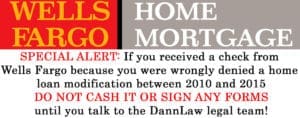

We have the honor of representing three people who lost their homes because they were unjustly denied a loan modification by Wells Fargo.

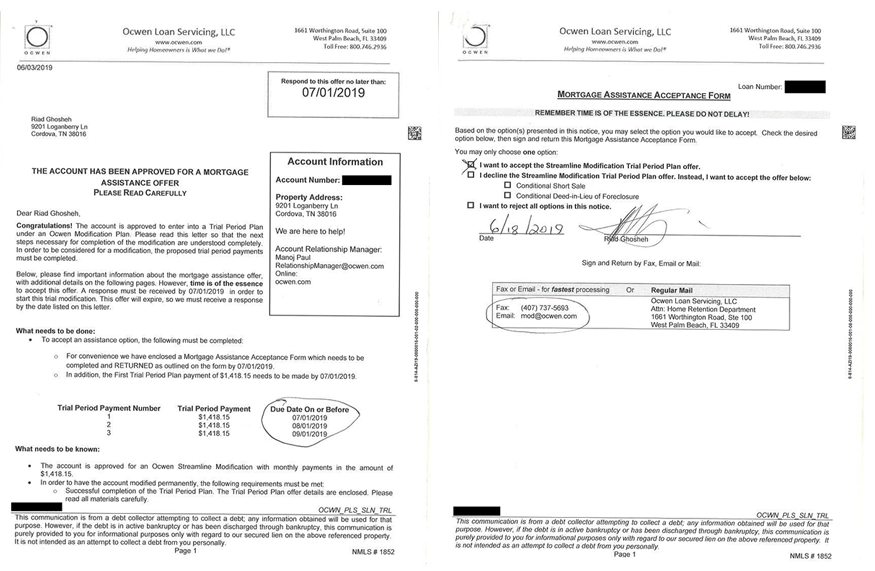

We have the honor of representing three people who lost their homes because they were unjustly denied a loan modification by Wells Fargo. Earlier this year Wells Fargo revealed in an SEC filing that a “software glitch” caused the bank to improperly deny mortgage loan modifications to 625 homeowners between 2010 and 2015. At the time, Wells said it had set aside eight million dollars to compensate borrowers impacted by the mistake, including the 400 families who lost their homes to foreclosure. Now victims of the incident are receiving checks from Wells. Attorney Marc Dann, founder and managing partner of DannLaw, is urging them to seek legal advice before accepting the money.

Earlier this year Wells Fargo revealed in an SEC filing that a “software glitch” caused the bank to improperly deny mortgage loan modifications to 625 homeowners between 2010 and 2015. At the time, Wells said it had set aside eight million dollars to compensate borrowers impacted by the mistake, including the 400 families who lost their homes to foreclosure. Now victims of the incident are receiving checks from Wells. Attorney Marc Dann, founder and managing partner of DannLaw, is urging them to seek legal advice before accepting the money.