Columbus, Ohio — In a landmark decision issued Tuesday, June 30, 2025, the Tenth District Court of Appeals of Ohio has affirmed a lower court’s order requiring Governor Mike DeWine and the Ohio Department of Job and Family Services (ODJFS) to take all necessary actions to reinstate Ohio’s participation in the Federal Pandemic Unemployment Compensation (FPUC) program. The ruling could result in the distribution of up to $900 million in additional unemployment benefits to eligible Ohioans who were denied payments after the state’s early withdrawal from the program in 2021. You may read and download the decision here: Bowling COA decision

Columbus, Ohio — In a landmark decision issued Tuesday, June 30, 2025, the Tenth District Court of Appeals of Ohio has affirmed a lower court’s order requiring Governor Mike DeWine and the Ohio Department of Job and Family Services (ODJFS) to take all necessary actions to reinstate Ohio’s participation in the Federal Pandemic Unemployment Compensation (FPUC) program. The ruling could result in the distribution of up to $900 million in additional unemployment benefits to eligible Ohioans who were denied payments after the state’s early withdrawal from the program in 2021. You may read and download the decision here: Bowling COA decision

The case, State ex rel. Candy Bowling et al. v. Michael DeWine, Governor of Ohio, et al., centered on Governor DeWine’s decision to terminate Ohio’s participation in the federally funded FPUC program, which provided supplemental unemployment benefits to workers impacted by the COVID-19 pandemic. Plaintiffs, representing a class of affected Ohioans, argued that the Governor’s action violated Ohio law, specifically R.C. 4141.43(I), which requires the state to cooperate with the federal government to secure all available advantages under federal unemployment programs.

The Franklin County Court of Common Pleas previously ruled in favor of the plaintiffs, ordering the state to rescind its early termination of the FPUC program and to seek retroactive benefits for the period from June 26 to September 6, 2021. Governor DeWine appealed, arguing that the case was moot and that Ohio law did not require the state to accept federal pandemic funds.

In today’s decision, the Court of Appeals rejected both arguments, holding:

- The case is not moot because it remains possible for Ohio to retroactively reinstate its participation in the FPUC program and obtain federal funds for eligible claimants. The U.S. Department of Labor has confirmed its willingness to consider such a request, even after the program’s expiration, particularly in response to a court order.

- The law of the case, as established in a prior appellate decision (Bowling I), requires the Governor to secure all available federal unemployment benefits for Ohioans, including those provided under the CARES Act and FPUC program.

- The Supreme Court of Ohio’s prior dismissal of an interlocutory appeal as moot did not resolve the underlying claims for relief, nor did it preclude the trial court or appellate court from addressing the merits of the case.

The Court of Appeals concluded: “For the foregoing reasons, we overrule Governor DeWine’s two assignments of error, and we affirm the judgment of the Franklin County Court of Common Pleas. … We remand this matter to the trial court for execution.”

What This Means for Ohioans

The decision paves the way for the state to seek and distribute retroactive FPUC benefits to eligible Ohioans who were denied payments after June 26, 2021. The court’s ruling underscores the state’s legal obligation to secure all available federal unemployment benefits for its citizens.

Statement from Plaintiffs’ Counsel Marc Dann

“We are gratified that the Court has affirmed the rights of Ohio workers and families who were unjustly denied critical pandemic relief,” said Marc E. Dann, lead counsel for the plaintiffs. “This decision is a victory for the rule of law and for the thousands of Ohioans who continue to struggle with the economic fallout of COVID-19.”

“This decision is especially important in light of the reductions in food assistance and other benefits that are reflected in the State Budget which the Governor will be signing today and the coming reductions in Medicaid including in the Big Beautiful Bill being debated today in the United States Senate. Injecting up to $3000 into 300,000 working class households will temporarily take the sting out of those cuts.” added Dann

Next Steps

The case will return to the Franklin County Court of Common Pleas for execution of the judgment. Governor DeWine and ODJFS are now under court order to take all necessary steps to reinstate Ohio’s participation in the FPUC program for the relevant period and to obtain and distribute the benefits to eligible claimants.

Media Contact:

Marc E. Dann

DannLaw

330-651-3131

[email protected]

About the FPUC Program:

The Federal Pandemic Unemployment Compensation (FPUC) program was established under the CARES Act to provide supplemental unemployment benefits to workers affected by the COVID-19 pandemic. The program initially provided an extra $600 per week, later reduced to $300 per week, for eligible claimants.

COLUMBUS, OH — Former Ohio Attorney General Marc Dann and former State Representative Jeffrey A. Crossman announced today that they will challenge the legality of using $600 million from Ohio’s Unclaimed Funds Trust (UFT) to finance a new stadium for the Cleveland Browns if the scheme is included in the Fiscal Year 2026/2027 biennial budget and signed into law.

COLUMBUS, OH — Former Ohio Attorney General Marc Dann and former State Representative Jeffrey A. Crossman announced today that they will challenge the legality of using $600 million from Ohio’s Unclaimed Funds Trust (UFT) to finance a new stadium for the Cleveland Browns if the scheme is included in the Fiscal Year 2026/2027 biennial budget and signed into law.

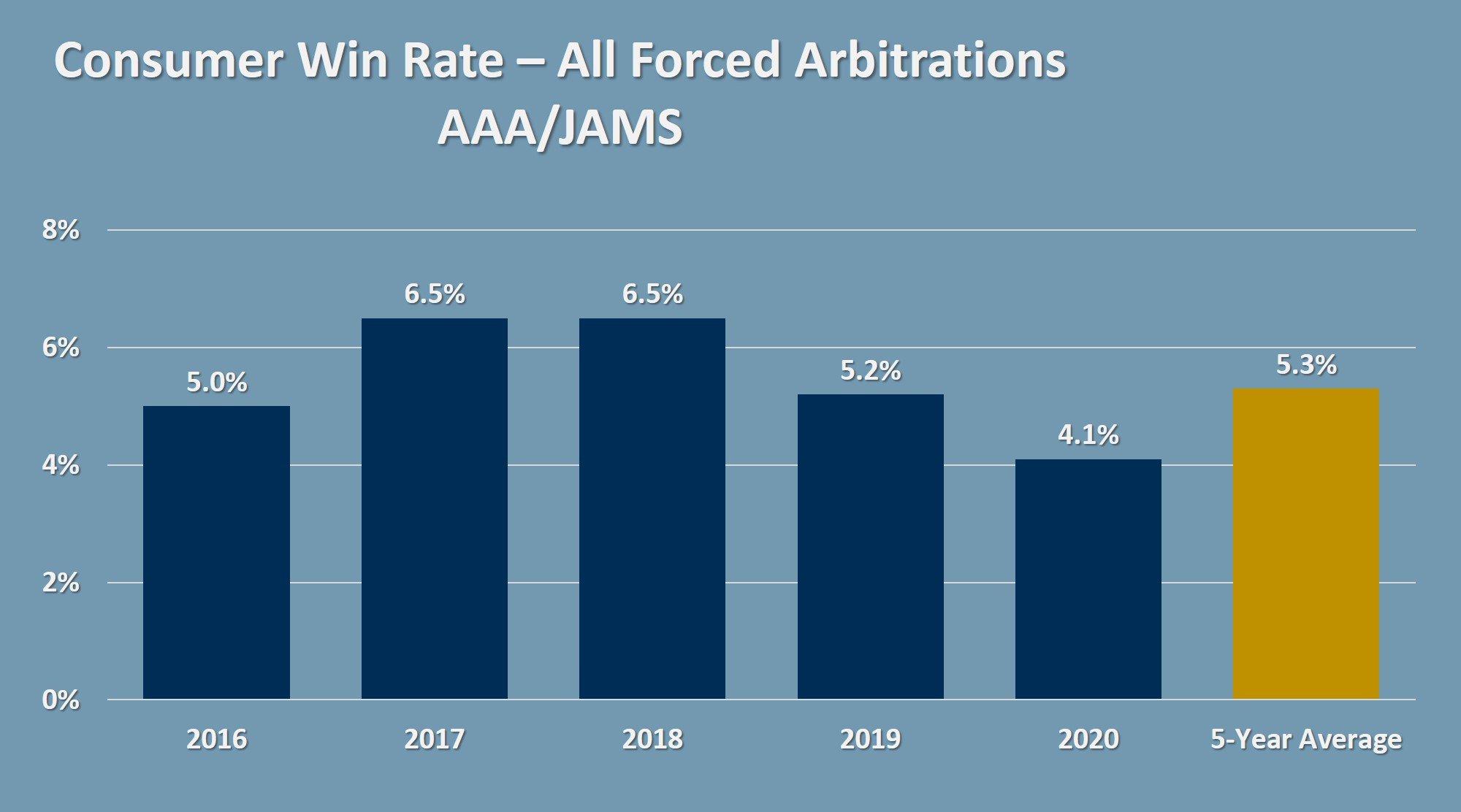

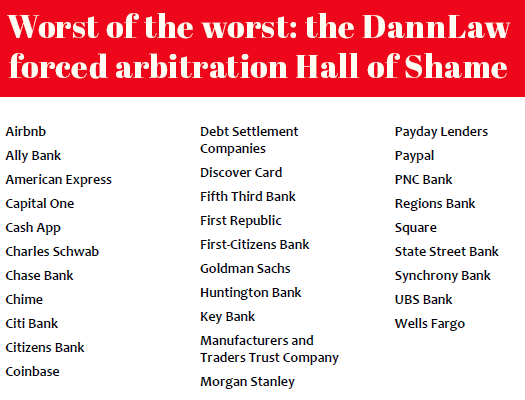

In reaction to their inexcusable inaction, DannLaw has formed a Forced Arbitration Practice Group led by attorneys Alisa Adams and Kurt Jones who have extensive experience pursuing and winning forced arbitration claims. Alissa, Kurt, and the Group’s talented paralegals are ready, willing, and more than able to take on banks, financial services firms, and any company that is using forced arbitration to prey upon, rip off, or exploit their customers.

In reaction to their inexcusable inaction, DannLaw has formed a Forced Arbitration Practice Group led by attorneys Alisa Adams and Kurt Jones who have extensive experience pursuing and winning forced arbitration claims. Alissa, Kurt, and the Group’s talented paralegals are ready, willing, and more than able to take on banks, financial services firms, and any company that is using forced arbitration to prey upon, rip off, or exploit their customers. It should come as no surprise to anyone that we have once again filed class action suits against Wells Fargo. Despite having paid more than

It should come as no surprise to anyone that we have once again filed class action suits against Wells Fargo. Despite having paid more than  Despite being exposed in media reports like this

Despite being exposed in media reports like this  Data breaches that enable cyberthieves to steal and misuse victims’ sensitive and confidential information is a growing problem in the U.S. That is why we are expanding our Data Privacy and Security Practice Group and working with the legal community to develop strategies that will ensure we can pursue and secure justice and just compensation for those put at risk when corporations, government agencies, and other entities fail to protect the personal data in their possession. As part of that effort, I am pleased to report that I was recently invited to serve on the prestigious

Data breaches that enable cyberthieves to steal and misuse victims’ sensitive and confidential information is a growing problem in the U.S. That is why we are expanding our Data Privacy and Security Practice Group and working with the legal community to develop strategies that will ensure we can pursue and secure justice and just compensation for those put at risk when corporations, government agencies, and other entities fail to protect the personal data in their possession. As part of that effort, I am pleased to report that I was recently invited to serve on the prestigious

If you received a postcard regarding the Madyda v. BMV case, it is because you are one of the people who paid a fee to have your driver’s licensed laminated by a deputy registrar between 2018 and 2020, even though the deputy registrars were not performing the service.

If you received a postcard regarding the Madyda v. BMV case, it is because you are one of the people who paid a fee to have your driver’s licensed laminated by a deputy registrar between 2018 and 2020, even though the deputy registrars were not performing the service.