Claiming that Wells Fargo has engaged in a “…pervasive pattern and practice of placing Black Americans at a disadvantage in comparison to White Americans with respect to their applications for mortgage loans,” attorneys from DannLaw and the Zimmerman Law Offices filed a class action lawsuit against the giant bank in the United States District Court for the Eastern District of New York on Tuesday, April 6, 2022. The pleading in the case may be viewed here: Ifemoa Ebo v Wells Fargo.

Claiming that Wells Fargo has engaged in a “…pervasive pattern and practice of placing Black Americans at a disadvantage in comparison to White Americans with respect to their applications for mortgage loans,” attorneys from DannLaw and the Zimmerman Law Offices filed a class action lawsuit against the giant bank in the United States District Court for the Eastern District of New York on Tuesday, April 6, 2022. The pleading in the case may be viewed here: Ifemoa Ebo v Wells Fargo.

Wells Fargo’s disturbing discriminatory behavior was documented in an extensive story published by Bloomberg in March. According to the report only 47% of Black homeowners who completed a refinance application with Wells Fargo in 2020 were approved, compared with 72% of White homeowners. By comparison other lenders had much smaller disparities in approval rates ranging from 7% to 12%. Bloomberg also noted that “Wells Fargo approved a greater share of applications from low-income White homeowners than all but the highest-income Black applicants, who had an approval rate about the same as White borrowers in the lowest-income bracket.”

Wells also discriminated against Blacks who applied for new mortgage loans. A review of publicly available data collected by the CFPB reveals that the bank approved applications submitted by Blacks at a rate 21% lower than those submitted by Whites. The disparity in approval rates at other lenders, including Chase, Quicken, United Wholesale Mortgage was approximately 10%.

Ms. Ebo’s case puts a face to Bloomberg’s reporting. In late 2021 she began searching for and found a new home in Brooklyn’s East Flatbush neighborhood. After signing a purchase agreement for $900,000 she submitted a mortgage loan application to Wells. At the time her credit score was approximately 800, her annual salary was $178,000, and she had no significant debt.

On November 1, 2021, Wells preapproved her for a loan of $883,698. The preapproval was set to expire on February 24, 2022. Ms. Ebo then immediately began working with the bank to secure final approval of the loan. She submitted all documentation requested by Wells, including W-2 forms, paystubs, and bank account statements in a timely fashion. On December 29, 2021, she received a “Commitment Letter” notifying her the application had been approved and advising her that she only needed to submit some additional documentation “in order to complete the final underwriting and funding of” the loan.

Things immediately went off the rails. In January and February Wells again asked for additional information much of which she had already submitted. She was also asked to provide items that were, according to the lawsuit, unnecessary, unduly burdensome, and irrelevant. For example, she was asked to explain why she made a monthly credit card payment of $290 to her own account and for a bank statement for a bank account that did not exist.

As Wells’ unnecessary and duplicative information requests continued into late February and March Ms. Ebo told the bank she was concerned her preapproval would expire before she received her loan even she was highly qualified and had supplied all documentation they had requested.

Her concern was justified. On March 22, 2022, the seller of the property cancelled the purchase contract with Ms. Ebo because Wells had not approved her financing and it was unclear if they ever would. She informed Wells of the seller’s decision that same day and accordingly, did not and never will receive the loan.

This is not the first time the lender has been accused of engaging discriminatory behavior. In 2012, the bank entered into a consent decree with the U.S. Justice Department to resolve claims it had unfairly steered Black and Hispanic borrowers into subprime mortgages and charged higher fees and interest rates than they did whites. At the time Wells paid $184 million to thousands of borrowers and agreed to adopt new compliance policies.

“Wells’ treatment of Ms. Ebo is unconscionable, illegal, but not surprising in light of the company’s history, Bloomberg’s reporting and the conversations we’ve had with others who were subjected to the bank’s outrageous practices,” DannLaw’s Javier Merino said. “Clearly, Wells has not been deterred by the laws that prohibit discrimination. Perhaps being held accountable in court will motivate them to change their ways and treat all applicants, regardless of race, equally and fairly in the future.”

The lawsuit seeks actual damages, statutory, and punitive damages, attorney fees and costs. For more information please contact Marc Dann at 330-651-3131.

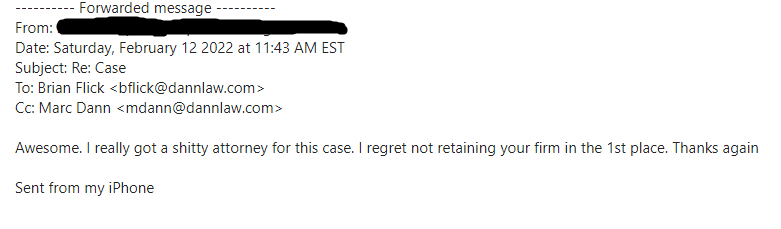

We love receiving shout-outs from our clients—even from those who took a little while to become our clients.

We love receiving shout-outs from our clients—even from those who took a little while to become our clients. From: xxxx

From: xxxx