DannLaw attorneys suspect troubled bank has understated number of victims, urges Wells borrowers who received loan modifications between 2010 and 2015 to seek legal advice.

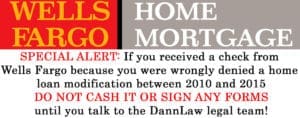

Earlier this year Wells Fargo revealed in an SEC filing that a “software glitch” caused the bank to improperly deny mortgage loan modifications to 625 homeowners between 2010 and 2015. At the time, Wells said it had set aside eight million dollars to compensate borrowers impacted by the mistake, including the 400 families who lost their homes to foreclosure. Now victims of the incident are receiving checks from Wells. Attorney Marc Dann, founder and managing partner of DannLaw, is urging them to seek legal advice before accepting the money.

Earlier this year Wells Fargo revealed in an SEC filing that a “software glitch” caused the bank to improperly deny mortgage loan modifications to 625 homeowners between 2010 and 2015. At the time, Wells said it had set aside eight million dollars to compensate borrowers impacted by the mistake, including the 400 families who lost their homes to foreclosure. Now victims of the incident are receiving checks from Wells. Attorney Marc Dann, founder and managing partner of DannLaw, is urging them to seek legal advice before accepting the money.

“A number of borrowers who received checks from Wells have contacted us to ask if the amount being offered is fair,” Atty. Dann said. “Obviously, families who went through the trauma of losing or almost losing their homes due to Wells’ incompetence deserve more than a few thousand bucks—especially if the company violated federal lending laws and rules. We’ve launched an investigation to determine if that’s true. No one should cash a check they receive from the company or sign a settlement agreement until our inquiry is complete.”

That investigation is likely to reveal Wells has understated the number of people damaged by the glitch. “Company officials admit 625 borrowers were improperly denied modifications,” Atty. Dann noted. “But that’s only part of the story. The same software error may have caused loan mods that were granted to be miscalculated. As a result, thousands of homeowners may be making payments that are much higher than they should be.”

“Wells has no intention of telling them about the problem, so we’re making a concerted effort to alert anyone whose mortgage was modified by Wells Fargo between 2010 and 2015 that they may have been cheated,” he said noting that borrowers with “conventional” loans owned by Fannie Mae or Freddie Mac comprise the pool of potential victims.

“Talking to those folks will enable us to assess whether and to what extent Wells violated lending laws and regs, including the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA)” Atty. Dann explained. “If we discover the law has been violated, borrowers could receive thousands of dollars in compensation from Wells whether they are a member of the group of 625 homeowners the bank admits to abusing or someone whose loan mod was miscalculated. In either case, we’re able and eager to take legal steps that will hold Wells accountable for its actions and make victims whole.”

Borrowers who receive a compensation/settlement check from Wells, as well as those who received a loan modification from the bank between 2010 and 2015, may call 877-475-8100 to arrange a free consultation with DannLaw.

Last year, Edwardo Sanchez, a paralegal in DannLaw’s

Last year, Edwardo Sanchez, a paralegal in DannLaw’s