While the $3.7 billion settlement between Wells Fargo and the Consumer Financial Protection Bureau is welcome news, it doesn’t resolve all the issues surrounding the bank’s bad behavior–a point made by CFPB Director Rohit Chopra who noted that Wells’ rinse-repeat cycle of violating the law has harmed millions of American families.” He also said the company is a serial offender that puts one third of American households at risk of harm and that finding permanent resolution to this bank’s pattern of unlawful behavior is a top priority.

While the $3.7 billion settlement between Wells Fargo and the Consumer Financial Protection Bureau is welcome news, it doesn’t resolve all the issues surrounding the bank’s bad behavior–a point made by CFPB Director Rohit Chopra who noted that Wells’ rinse-repeat cycle of violating the law has harmed millions of American families.” He also said the company is a serial offender that puts one third of American households at risk of harm and that finding permanent resolution to this bank’s pattern of unlawful behavior is a top priority. While the $3.7 billion settlement between Wells Fargo and the Consumer Financial Protection Bureau is welcome news, it doesn’t resolve all the issues surrounding the bank’s bad behavior–a point made by CFPB Director Rohit Chopra who noted that Wells’ rinse-repeat cycle of violating the law has harmed millions of American families.” He also said the company is a serial offender that puts one third of American households at risk of harm and that finding permanent resolution to this bank’s pattern of unlawful behavior is a top priority.

While the $3.7 billion settlement between Wells Fargo and the Consumer Financial Protection Bureau is welcome news, it doesn’t resolve all the issues surrounding the bank’s bad behavior–a point made by CFPB Director Rohit Chopra who noted that Wells’ rinse-repeat cycle of violating the law has harmed millions of American families.” He also said the company is a serial offender that puts one third of American households at risk of harm and that finding permanent resolution to this bank’s pattern of unlawful behavior is a top priority. Along with forbearance and other relief programs, foreclosure stays are ending. That means hundreds and perhaps thousands of new judicial foreclosure actions will be filed in Ohio, New Jersey and other states. We have the experience, expertise, and knowledge needed to save your home.

Along with forbearance and other relief programs, foreclosure stays are ending. That means hundreds and perhaps thousands of new judicial foreclosure actions will be filed in Ohio, New Jersey and other states. We have the experience, expertise, and knowledge needed to save your home. Multiple courts have selected DannLaw to serve as Class Counsel in data breach Cases. A data breach occurs when a company fails to properly safeguard its customers’ personal information. Our legal staff devotes considerable time and resources to pursuing and securing just compensation for the inconvenience, expense, and aggravation data breach victims endure.

Multiple courts have selected DannLaw to serve as Class Counsel in data breach Cases. A data breach occurs when a company fails to properly safeguard its customers’ personal information. Our legal staff devotes considerable time and resources to pursuing and securing just compensation for the inconvenience, expense, and aggravation data breach victims endure.

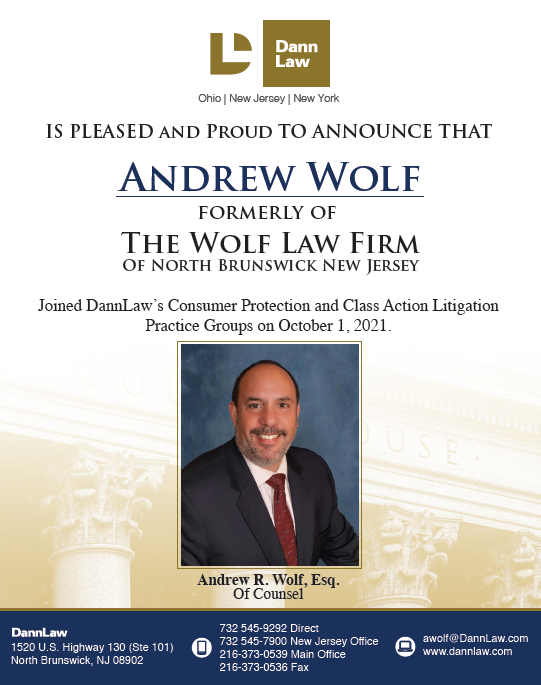

DannLaw founder and former Ohio Attorney General Marc Dann announced today that Attorney Andrew Wolf of North Brunswick, New Jersey has become an “Of Counsel” member of DannLaw’s Consumer Protection and Class Action Litigation Practice groups. Wolf, who has earned a reputation as one of the nation’s most effective consumer advocates will be based in DannLaw’s New Jersey/New York office.

DannLaw founder and former Ohio Attorney General Marc Dann announced today that Attorney Andrew Wolf of North Brunswick, New Jersey has become an “Of Counsel” member of DannLaw’s Consumer Protection and Class Action Litigation Practice groups. Wolf, who has earned a reputation as one of the nation’s most effective consumer advocates will be based in DannLaw’s New Jersey/New York office. “Filing the class action was the only way to secure justice and obtain compensation for motorists victimized by Girard and Blue Line,” Atty. Dann said. “City officials won’t admit they were wrong, continue to falsely claim they were not aware of the fact that construction had been completed and the speed limit raised to 65 MPH, and refuse to refund money they essentially pilfered from innocent people. Now that Blue Line has settled, we are going to focus our efforts on holding city officials accountable for their actions—no matter how long that may take.”

“Filing the class action was the only way to secure justice and obtain compensation for motorists victimized by Girard and Blue Line,” Atty. Dann said. “City officials won’t admit they were wrong, continue to falsely claim they were not aware of the fact that construction had been completed and the speed limit raised to 65 MPH, and refuse to refund money they essentially pilfered from innocent people. Now that Blue Line has settled, we are going to focus our efforts on holding city officials accountable for their actions—no matter how long that may take.”