Today, we’re going to tell you story about good vs. evil, right vs. wrong. The main character in the tale is Riad Ghosheh who owns a home that Ocwen Loan Servicing LLC and PHH Mortgage Services tried to steal. They’re the bad guys.

How bad?

As of this year, more than 11,000 complaints against Ocwen had been lodged with the Consumer Financial Protection Bureau (CFPB). PHH, which Ocwen acquired in 2018, has been tagged 781 times. Ocwen, a company we’ve fought and written about many times, is truly among the worst of the bad actors that populate the mortgage servicing industry. It won’t come as a surprise that the company no longer operates under the Ocwen name. They decided to hide behind PHH’s relatively clean reputation. But believe us, Ocwen’s back there pulling the strings.

Those are the bad guys. Who are the good guys?

Well us, of course, the DannLaw legal team. When Riad learned that Ocwen/PHH was about to steal his home he contacted us. Here’s a spoiler alert: we saved his house. On October 30, Federal District Court Judge Mark Norris issued a temporary restraining order that stopped the bad guys from moving forward with a foreclosure that was scheduled for November 1. In the wake of Judge Norris’ ruling, Ocwen/PHH has decided to abort its attempt to swipe Riad’s residence. You can read Judge Norris’ order here: tnwd-2_2019-cv-02710-00015 (1)

Talk about riding to the rescue just in the nick of time…

But the saga doesn’t end there. Simply saving Riad’s house didn’t seem like justice to him or us. Ocwen/PHH had put him through a horrible ordeal. They broke the law—in fact, they broke a bunch of them. So we’re using those laws, in particular the Real Estate Sales Practices Act (RESPA) to hold Ocwen/PHH accountable and make them pay for nearly wrecking Riad’s finances and disrupting his life. You can read the complaint we filed against the companies in Federal District Court for the Western District of Tennessee here: Ghosheh Riad 2019 10 18 TS Complaint

Truth be told, we’ve helped hundreds of people like Riad over the years. But his story is both especially compelling and infuriating, so we thought we’d share it, both as a cautionary tale and to illustrate the strategies we use to fight giant banks and mortgage servicers—and WIN.

Here’s our story…

Riad Ghosheh, who is legally deaf and partially blind, owns a home in Cordova, Tennessee, a community just east of Memphis. Earlier this year, Riad went to Israel for an extended period of time to take care of family business. Before leaving he asked his son to make the mortgage payments on the home and gave him the money to do so.

You can probably guess what happened next: his son didn’t make the payments. Riad returned to the United States and learned that his loan had gone into default. Needless to say, this was not the homecoming gift he expected.

In order to stop the home from going into foreclosure, Riad filed for Chapter 13 bankruptcy on June 3, 2019. As we’ve noted in our blogs and on our website, filing Chapter 13 immediately brings foreclosure actions to a dead stop.

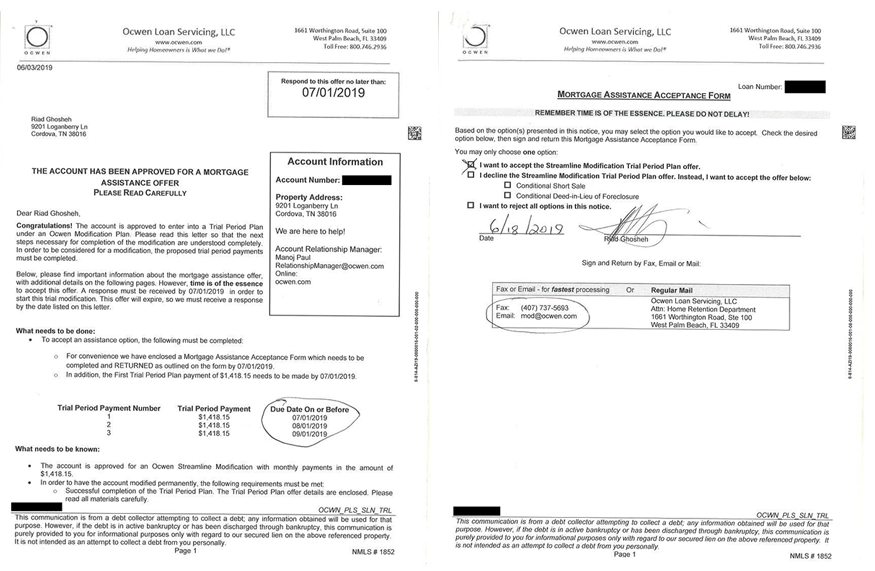

On or about the same day, Riad received a “Streamline Modification Trial Period Plan” (TPP) from Ocwen his loan servicer. Loan modification plans like this are designed to give homeowners the opportunity to prove they can make their mortgage payments and resolve arrearages. They are also supposed to stop foreclosures. Note the use of the word “supposed.” This will be important in just a bit.

If he accepted the proposed TPP, Riad would be required to make three payments of $1,418.15 beginning July 1. If he made the three payments on time, the company would offer him a permanent loan modification plan. Riad signed the TPP on June 18, 2019, and mailed it to Ocwen the same day.

Because he knew he could afford to make the payments called for in the TPP and because the agreement was supposed to prevent Ocwen from foreclosing on his home, Riad allowed his bankruptcy petition to be dismissed. After all, his main reason for filing was to save his home from foreclosure—a threat he supposedly no longer faced.

There’s that word again.

On June 24, Riad, as required by the TPP, made the July payment of $1,418.15. Records show Ocwen received the payment on June 28. He made the August payment on July 24 and the September payment on August 26. Three payments required. Three payments made—early.

So far so good, right?

Look, we told you this was a story of good vs. evil, not a fairy tale. Things were far from good.

Here’s what happened to the three payments:

Ocwen kept the July payment but never applied it to Riad’s loan;

On September 22, PHH, which had taken over the loan, sent the August payment back along with a letter notifying Riad that he had violated the terms of the TPP;

The September payment, which was made nearly a month before PHH sent back the August payment, is MIA. No one at Ocwen/PHH can find it.

Riad was, to say the least, alarmed by these events, so he asked the person who held his power of attorney to contact the bankruptcy lawyer who had filed the Chapter 13 petition on his behalf earlier in the year.

This was a good call on Riad’s part because the bankruptcy attorney was the person who notified him that his house was slated to be sold out from under him on November 1. Ocwen/PHH had never contacted him or his counsel. The lawyer only knew the sale was about to take place because he saw it advertised in the newspaper. It appears the fine folks at Ocwen/PHH who forgot to apply Riad’s July payment to his mortgage then forgot to notify him that they were about to steal his home did remember to advertise the attempted theft in the paper.

At this point, put yourself in Riad’s place. You trusted your kid to make your house payments. He didn’t.

You trusted your mortgage servicer to play by the rules and honor the terms of a mortgage modification plan they offered you. They didn’t.

You assumed that Ocwen/PHH would abide by the laws that govern the mortgage servicing industry. Of course they didn’t. Abiding by the law is not part of their business model.

And as a result of it all, you came within days of becoming homeless—even though you did everything you were supposed to do.

And Riad, like thousands of other people who have been victimized by Ocwen, would have been homeless had he not contacted the DannLaw team.

As we mentioned above, we’ve already saved Riad’s home. Now we’re suing Ocwen/PHH in Federal Court to make them pay for the emotional and physical distress their sordid behavior caused, for damaging Riad’s credit, and for violating both RESPA and Fair Debt Collection Practices Act (FDCPA). Our filing alleges that Ocwen/PHH did the following:

Count One: RESPA Violations

Count Two: Breach of Contract

Count Three: Promissory Estoppel (OK, we know you don’t know what that is, and the explanation is really long and complicated, but take our word for it, Ocwen/PHH did it.)

Count Four: Conversion

Count Five: Unjust Enrichment (This one is easy to understand, it basically means Ocwen/PHH stole Riad’s cash.)

Count Six: Violations of the FDCPA

The best thing is, Riad doesn’t have to pay us to wage this battle on his behalf. If we win the case, Ocwen/PHH will be required to pay our fees and we will receive a small percentage of any damages the court awards.

And the damages part is no fairytale—we’ve won significant financial awards for people like Riad numerous times in courts across the U.S.

That’s our story. We’ll let you know how it ends. But in the meantime, if you or someone you know is facing foreclosure or is being abused by a bank or mortgage servicer, don’t be a victim. Fight back like Riad, by contacting the experienced foreclosure defense attorneys at DannLaw. You can reach us by calling the office near you or by completing the form on our Contact page.

We’ll be happy to schedule a no-cost consultation, provide you with sound legal advice, and help you save your home and win the financial settlement you deserve.

A recent federal appeals court decision may spell “relief” for Americans buried under private student loan debt held by Navient. In a unanimous decision, a three-judge panel of the Court of Appeals for the Fifth Circuit held that Navient private student loans ARE dischargeable in bankruptcy.

A recent federal appeals court decision may spell “relief” for Americans buried under private student loan debt held by Navient. In a unanimous decision, a three-judge panel of the Court of Appeals for the Fifth Circuit held that Navient private student loans ARE dischargeable in bankruptcy. DannLaw today filed suit against the owners of the Homewood Suites by Hilton hotel located in Mahwah, New Jersey and Hilton Worldwide Holdings, Inc. for repeatedly violating both the Americans with Disabilities Act (ADA) and New Jersey’s anti-discrimination laws. The suit, filed on behalf of Erika Symmonds, alleges that the defendants twice failed to provide ADA-compliant accommodations after confirming that mobility accessible rooms were available at the Mahwah, NJ facility. The pleading in the case, which was filed today in the Federal District Court for the District of New Jersey may be viewed and downloaded here:

DannLaw today filed suit against the owners of the Homewood Suites by Hilton hotel located in Mahwah, New Jersey and Hilton Worldwide Holdings, Inc. for repeatedly violating both the Americans with Disabilities Act (ADA) and New Jersey’s anti-discrimination laws. The suit, filed on behalf of Erika Symmonds, alleges that the defendants twice failed to provide ADA-compliant accommodations after confirming that mobility accessible rooms were available at the Mahwah, NJ facility. The pleading in the case, which was filed today in the Federal District Court for the District of New Jersey may be viewed and downloaded here: