While the $3.7 billion settlement between Wells Fargo and the Consumer Financial Protection Bureau is welcome news, it doesn’t resolve all the issues surrounding the bank’s bad behavior–a point made by CFPB Director Rohit Chopra who noted that Wells’ rinse-repeat cycle of violating the law has harmed millions of American families.” He also said the company is a serial offender that puts one third of American households at risk of harm and that finding permanent resolution to this bank’s pattern of unlawful behavior is a top priority.

While the $3.7 billion settlement between Wells Fargo and the Consumer Financial Protection Bureau is welcome news, it doesn’t resolve all the issues surrounding the bank’s bad behavior–a point made by CFPB Director Rohit Chopra who noted that Wells’ rinse-repeat cycle of violating the law has harmed millions of American families.” He also said the company is a serial offender that puts one third of American households at risk of harm and that finding permanent resolution to this bank’s pattern of unlawful behavior is a top priority. While the $3.7 billion settlement between Wells Fargo and the Consumer Financial Protection Bureau is welcome news, it doesn’t resolve all the issues surrounding the bank’s bad behavior–a point made by CFPB Director Rohit Chopra who noted that Wells’ rinse-repeat cycle of violating the law has harmed millions of American families.” He also said the company is a serial offender that puts one third of American households at risk of harm and that finding permanent resolution to this bank’s pattern of unlawful behavior is a top priority.

While the $3.7 billion settlement between Wells Fargo and the Consumer Financial Protection Bureau is welcome news, it doesn’t resolve all the issues surrounding the bank’s bad behavior–a point made by CFPB Director Rohit Chopra who noted that Wells’ rinse-repeat cycle of violating the law has harmed millions of American families.” He also said the company is a serial offender that puts one third of American households at risk of harm and that finding permanent resolution to this bank’s pattern of unlawful behavior is a top priority. Brian Flick for 62nd District, Ohio House of Representatives

Brian Flick for 62nd District, Ohio House of Representatives My relationship with Tim stretches back decades—to the time he defeated me in Democratic primary for the 32nd District seat in the Ohio State Senate. I know and trust him, and I admire the tireless battle he has waged on behalf of working families, organized labor, and consumers in both the state legislature and Congress. We can count on Tim to be a strong advocate for Consumers and a member of the Senate who has the courage to stand up to Wall Street Banks and other financial predators.

My relationship with Tim stretches back decades—to the time he defeated me in Democratic primary for the 32nd District seat in the Ohio State Senate. I know and trust him, and I admire the tireless battle he has waged on behalf of working families, organized labor, and consumers in both the state legislature and Congress. We can count on Tim to be a strong advocate for Consumers and a member of the Senate who has the courage to stand up to Wall Street Banks and other financial predators. I know as well as anyone how important the office of Attorney General is to protecting Consumers in Ohio. Jeff Crossman grew up working class and he is passionately committed to standing up for Ohio Consumers and taxpayers without being restrained by his allegiance to corporate lobbyists like the current Attorney General David Yost.

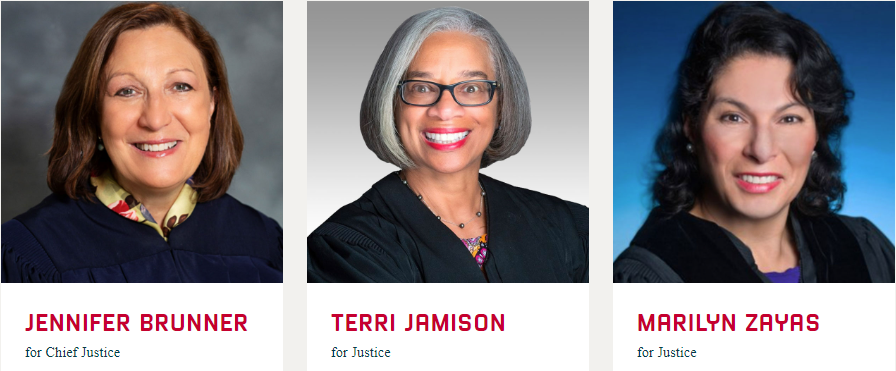

I know as well as anyone how important the office of Attorney General is to protecting Consumers in Ohio. Jeff Crossman grew up working class and he is passionately committed to standing up for Ohio Consumers and taxpayers without being restrained by his allegiance to corporate lobbyists like the current Attorney General David Yost. Anyone who reads the opinions written and rulings made by the six jurists who are vying for three seats on the Ohio Supreme Court will conclude that Jennifer Brunner, Teri Jamison, and Marilyn Zayas are clearly the best choice for these important posts. Both Justice Brunner and Judge Jamison, who serves on the Tenth District Court of Appeals, have made favorable rulings in the UI case and they, along with Judge Zayas have established a long record of ensuring that “equal justice under law” is more than a slogan. Consumers will be better served by Brunner, Jamison and Zayas.

Anyone who reads the opinions written and rulings made by the six jurists who are vying for three seats on the Ohio Supreme Court will conclude that Jennifer Brunner, Teri Jamison, and Marilyn Zayas are clearly the best choice for these important posts. Both Justice Brunner and Judge Jamison, who serves on the Tenth District Court of Appeals, have made favorable rulings in the UI case and they, along with Judge Zayas have established a long record of ensuring that “equal justice under law” is more than a slogan. Consumers will be better served by Brunner, Jamison and Zayas. In its endorsement editorial of Republican Judge Joan Synenberg, Cleveland.com noted the following:

In its endorsement editorial of Republican Judge Joan Synenberg, Cleveland.com noted the following: Along with forbearance and other relief programs, foreclosure stays are ending. That means hundreds and perhaps thousands of new judicial foreclosure actions will be filed in Ohio, New Jersey and other states. We have the experience, expertise, and knowledge needed to save your home.

Along with forbearance and other relief programs, foreclosure stays are ending. That means hundreds and perhaps thousands of new judicial foreclosure actions will be filed in Ohio, New Jersey and other states. We have the experience, expertise, and knowledge needed to save your home. Multiple courts have selected DannLaw to serve as Class Counsel in data breach Cases. A data breach occurs when a company fails to properly safeguard its customers’ personal information. Our legal staff devotes considerable time and resources to pursuing and securing just compensation for the inconvenience, expense, and aggravation data breach victims endure.

Multiple courts have selected DannLaw to serve as Class Counsel in data breach Cases. A data breach occurs when a company fails to properly safeguard its customers’ personal information. Our legal staff devotes considerable time and resources to pursuing and securing just compensation for the inconvenience, expense, and aggravation data breach victims endure. Claiming that Wells Fargo has engaged in a “…pervasive pattern and practice of placing Black Americans at a disadvantage in comparison to White Americans with respect to their applications for mortgage loans,” attorneys from DannLaw and the Zimmerman Law Offices filed a class action lawsuit against the giant bank in the United States District Court for the Eastern District of New York on Tuesday, April 6, 2022. The pleading in the case may be viewed here:

Claiming that Wells Fargo has engaged in a “…pervasive pattern and practice of placing Black Americans at a disadvantage in comparison to White Americans with respect to their applications for mortgage loans,” attorneys from DannLaw and the Zimmerman Law Offices filed a class action lawsuit against the giant bank in the United States District Court for the Eastern District of New York on Tuesday, April 6, 2022. The pleading in the case may be viewed here: