Marc Dann and Brian Flick of DannLaw, one of the nation’s leading consumer protection law firms and Attorney Andrew Engel of Advocate Attorneys, LLP, today filed suit in Cuyahoga County Common Pleas Court to force Governor Mike DeWine and Matt Damschroeder, Director of the Ohio Department of Jobs and Family Services to rescind their decision to terminate Ohio’s participation in the Federal Pandemic Unemployment Compensation (FPUC), Pandemic Unemployment Assistance (PUA), Pandemic Emergency Unemployment Compensation (PEUC) programs. The first hearing in the case has been set for July 21, 2021 at 1:30 P.M. before Judge Michael P. Shaughnessy in Courtroom 16 C in the Cuyahoga County Justice Center, 1200 Ontario St, Cleveland, OH.

DeWine and Damschroder announced on May 13, 2021 that the federally-funded benefits would be cutoff on June 26, 2021. Ohio is one of 27 states governed by Republicans that decided to terminate the benefits early.

“Along with jeopardizing the personal and financial well-being of Ohioans who are struggling to recover from the pandemic, DeWine and Damschroder’s callous and politically-motivated decision to terminate the federal benefits represents a willful and blatant violation of Ohio law,” Brian Flick said.

According to the lawsuit, Ohio Revised Code Section ORC 4141.43(I) requires Damschroder to

“…cooperate with the United States department of labor to the fullest extent…[and] take such action…as may be necessary to secure to this state and its citizens all advantages available under the provisions of the “Social Security Act” that relate to unemployment compensation…”

The mandamus action asks the Cuyahoga County Common Pleas Court to:

- Declare Governor Dewine and Director Damschroder to be in violation of their statutory duties under R.C. 4141.43(I) by terminating Ohio’s participation in PUA, PEUC, and FUPC benefits as of the week of June 26, 2021;

- Enjoin Dewine, Damschroder, their officers, employees, and agents, from withdrawing the State of Ohio from unemployment benefits offered through the CARES Act;

- Order Dewine and Damschroder to immediately notify the United States Department of Labor of Ohio will participate in the programs for their duration;

- Issue a peremptory writ of mandamus requiring the Defendants’ perform their statutory duties required by ORC 4141.43(I) and immediately take all action necessary to reinstate Ohio’s participation in all federal unemployment insurance benefit available from the United States Department of Labor.

DannLaw and Advocate Attorneys are also seeking a Temporary Restraining Order and Preliminary Injunction enjoining Dewine and Damschroder from denying Ohioans

the right to receive FPUC benefits.

The mandamus action may be viewed here: Bowling Candy 2021 07 06 First Amended Complaint TO FILE

The motion for a temporary restraining order may be viewed here: Bowling Candy 2021 07 05 Motion for TRO Final

Similar suits have been filed in three other states: Indiana, Maryland, and Texas. On June 25 Indiana Superior Court Judge John Hanley ruled that the state must continue paying the benefits and said “Indiana law recognizes the importance of these benefits. Indiana law requires the State to accept these benefits.” Court action is pending in Maryland and Texas.

“Indiana’s statutory language is very similar to Ohio’s,” Atty. Dann noted. “We believe we are right on the law an absolutely right as it relates to public policy that protects the interests of the people of the state of Ohio.”

For more information, please contact Atty. Marc Dann at 216-373-0539 or by emailing [email protected]

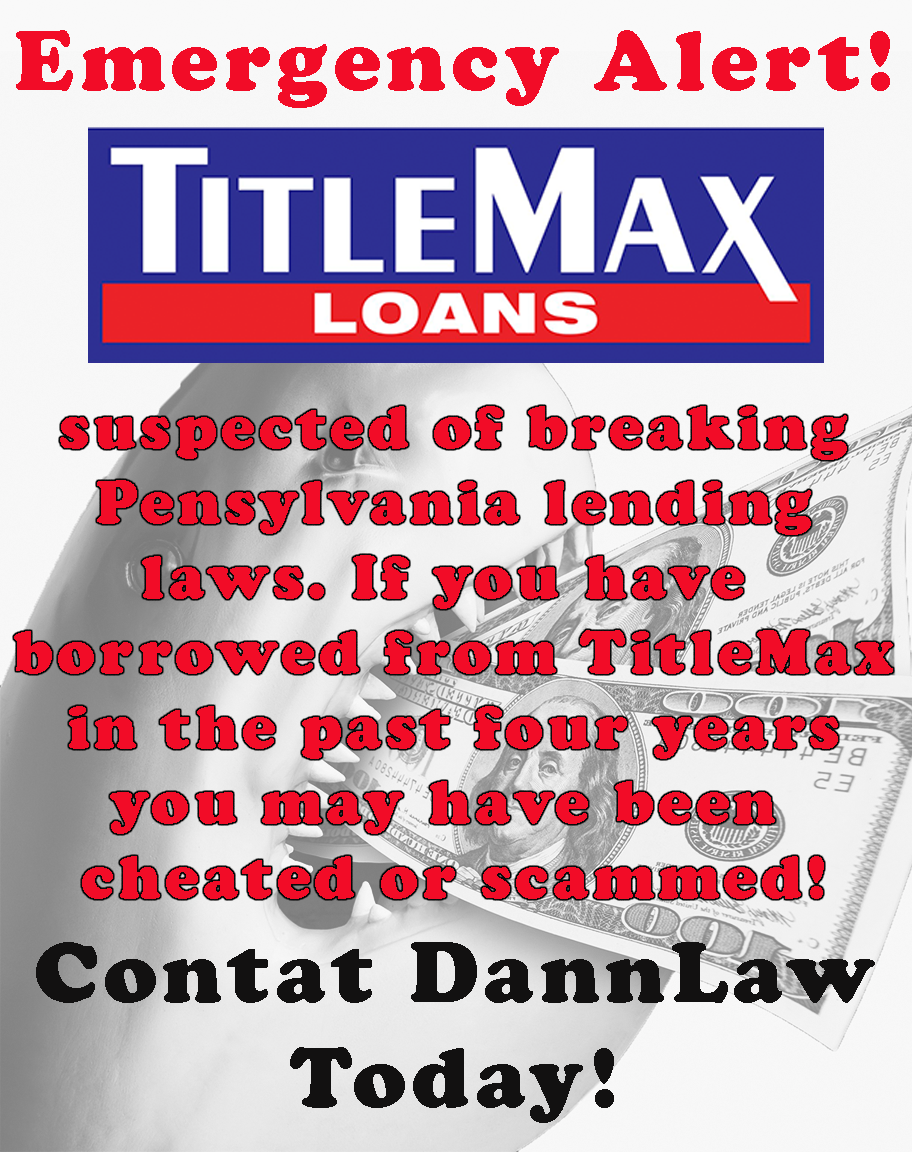

The consumer protection team at DannLaw and Advocate Attorneys, along with Atty. Nathan Lloyd Gess are investigating reports that TitleMax has repeatedly violated Pennsylvania’s lending laws by charging borrowers interest rates that would make a loan shark blush. If you or someone you know has borrowed from TitleMax in the Keystone State in the past four years we urge you to contact DannLaw TODAY by calling 877-475-8100 or using the contact form on our website: www.

The consumer protection team at DannLaw and Advocate Attorneys, along with Atty. Nathan Lloyd Gess are investigating reports that TitleMax has repeatedly violated Pennsylvania’s lending laws by charging borrowers interest rates that would make a loan shark blush. If you or someone you know has borrowed from TitleMax in the Keystone State in the past four years we urge you to contact DannLaw TODAY by calling 877-475-8100 or using the contact form on our website: www. Important notice for anyone who received a letter from a lodging chain regarding the TravelClick date breach: Don’t delay. Protect yourself and your family. Contact DannLaw TODAY!

Important notice for anyone who received a letter from a lodging chain regarding the TravelClick date breach: Don’t delay. Protect yourself and your family. Contact DannLaw TODAY!