An important message from Marc Dann:

An important message from Marc Dann:

We are open and reachable during normal business hours and beyond and you can reach me on my cell phone at 330-651-3131. Rest assured that I will either be at home or at the office because like you, I’m really not allowed to go anywhere else. We will be happy to answer any questions you have about your existing case(s) as well as the many coronavirus-related legal issues our friends and clients are facing on an almost hourly basis. If you need to speak to one of our attorneys please use our toll-free line 877-475-8100. We answer 24 hours a day.

Here are several things to remember:

- We can arrange for phone and video conferences for new and existing clients.

- You can make retainer payments online. If you are a client of our Ohio office click here: DannLaw Payment Link Clients of our New Jersey office click here: DannLaw NJ Payment Link

- If you are experiencing additional financial hardship related to the COVID-19 emergency and need to make financial arrangements please contact us right away.

- We are constantly monitoring legal developments related to the emergency that are important to consumers, borrowers, homeowners, and small businesses. If you have questions or need information please contact us and we will try to find answers for you.

- If you are unable to make your mortgage payment or pay other consumer debts please contact us so we can discuss options and alternative strategies. We can’t help you unless and until you contact us.

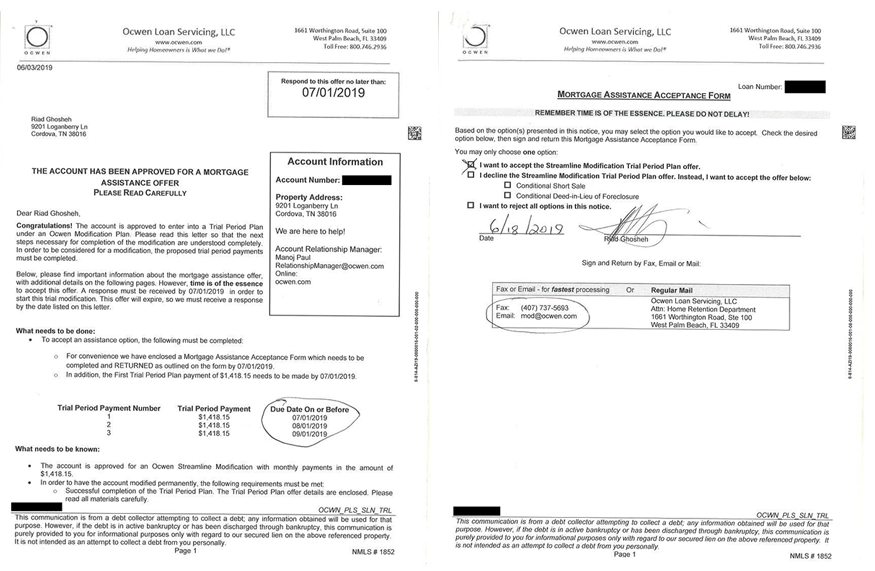

- If you are in Chapter 13 Bankruptcy and are unable to make a Chapter 13 Payment, please contact us ASAP so we can discuss options and alternative strategies. Working preemptively with the Chapter 13 Trustee and the Court regarding payments will help avoid unnecessary Motions to Dismiss.

- For our clients in Chapter 13 Bankruptcy and all other clients: the COVID-19 emergency has not changed deadlines for filing tax returns.

Here are some other important developments:

- Ohioans can now apply for and receive unemployment benefits immediately if they are laid off due to the emergency. Click here for information about how to apply online for unemployment benefits.

- SBA Loans should be available to Small Business Owners facing financial challenges from the current situation. Click here to learn more.

- Judge Brendan Sheehan in Cuyahoga County has issued a 60 day stay on foreclosure sales and on the prosecution of foreclosure cases. See the details here. Please note that all deadlines that apply to those in foreclosure or who are working to resolve disputes with their mortgage companies remain in effect. Rules and regulations have not been adjusted. Lawsuits that have been filed and served must be answered. Any matter that needs to be objected to or appealed would not be covered by this order. This is good news but please keep in close touch with us about your existing case or any issues you might learn about relating to your mortgage. If you have questions, please email Attorney Whitney Kaster at [email protected].

- While Cuyahoga County has stayed these cases, many other courts in Ohio have not. One of our Partners, Brian Flick in his role as Ohio Chairperson of the National Association of Consumer Attorneys wrote to Chief Justice Maureen O’Connor on March 16, 2020 asking that she issue guidance to local courts to stay all non-essential Debt Collection and Eviction Cases and to postpone all pending Sheriff’s sales until the State of Emergency Declaration is terminated. If you are in a County that has not adopted emergency procedures staying civil cases, please email [email protected] He and NACA are committed to ensuring access and due process to all consumers during the pandemic.

- Both the Hamilton County Municipal Court and the Court of Common Pleas have issued a 30-day stay of all civil and criminal trials in the Courts (with limited exceptions). See the details here. This is good news but please keep in close touch with us about an existing case or any issues you may learn of related to your case. If you have questions, please email Brian Flick at [email protected].

- The New Jersey Legislature has enacted statewide mortgage relief including forbearance of payments and a stay on foreclosure proceedings. Here is what we know about it. The same disclaimer applies here: Please note that all deadlines that apply to those in foreclosure or who are working to resolve disputes with their mortgage companies remain in effect. Rules and regulations have not been adjusted. Lawsuits that have been filed and served must be answered. Any matter that needs to be objected to or appealed is not covered by this order. Javier Merino stands ready to answer all of your New Jersey Consumer Law Questions [email protected]

- My earlier post on how to protect yourself if you experience financial hardship is here.

- The Ohio State Bar has advice on what your employer may and may not do.

- The Veterans Administration has directed servicers to not report to credit agencies or assess late fees to borrowers who are late as a result of the virus.For more information on that contact [email protected]

As always we stand ready to help our friends, neighbors and clients as this crisis unfolds. Never hesitate to call 877-475-8100 or email us at [email protected] or [email protected].

A recent federal appeals court decision may spell “relief” for Americans buried under private student loan debt held by Navient. In a unanimous decision, a three-judge panel of the Court of Appeals for the Fifth Circuit held that Navient private student loans ARE dischargeable in bankruptcy.

A recent federal appeals court decision may spell “relief” for Americans buried under private student loan debt held by Navient. In a unanimous decision, a three-judge panel of the Court of Appeals for the Fifth Circuit held that Navient private student loans ARE dischargeable in bankruptcy.