In a recent article posted on Columbia Law School’s Blue Sky Blog, Jeff Sovern argues that businesses should not be able to use the Federal Arbitration Act (FAA) to harm consumers. We agree. This flaw in the law costs American families tens of millions of dollars each year. That’s why DannLaw has been fighting for real reform of the FAA including urging the Consumer Financial Protection Bureau to issue a new rule that would block the use of arbitration clauses in consumer financial contracts. Unfortunately, until the CFPB or Congress acts, consumers will continue to be victimized by greedy corporations.

Whether you’re an attorney battling on behalf of clients or a consumer who has been ripped off by a mortgage lender, credit card company, or retailer, contact the consumer arbitration experts at DannLaw. We’re ready to help you fight and win. To learn more complete our contact form or call 330-294-3226.

We’ve posted Mr. Sovern’s CLS Blue Sky blog post below. To read a version with footnotes click here.

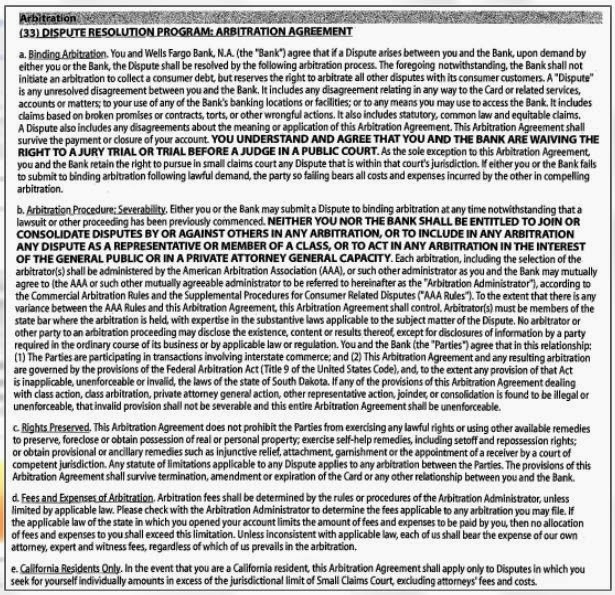

Consumer protection laws face a fundamental enforcement issue: Because consumer claims are typically for small amounts, and litigation is expensive, it rarely makes economic sense for consumers to litigate their claims individually. Partly to deal with this problem, lawmakers created class actions so the cost of litigation could be shared among many claims. But businesses have used the Federal Arbitration Act against consumers, inserting into agreements arbitration clauses that block consumer class actions. The U. S. Supreme Court has ruled these clauses are valid.[1] As a result, few consumers assert claims subject to these contracts unless a substantial amount of money is at issue.

This leads to two unfortunate outcomes. First, in many situations, merchants employing arbitration clauses need not fear that they will face private enforcement of consumer protection laws and so are insufficiently deterred from engaging in misconduct that might otherwise lead to liability. Second, consumers lack an effective means to secure compensation unless they suffer huge losses. The problem is worsened by the fact that consumers cannot understand arbitration clauses and so surrender their rights to litigate in court without realizing that they are doing so.

In a new book chapter, I argue that Congress should amend the FAA to exclude consumer claims from the FAA’s coverage until a dispute has arisen. Otherwise, the Consumer Financial Protection Bureau (“CFPB”) should use its rule-making power to limit the use of arbitration clauses in consumer financial contracts.

Arbitration and Claim Suppression

Multiple studies show that few consumers commence arbitration claims unless substantial sums are at issue. [2]Arbitration clauses’ claim-suppression effect was illustrated colorfully by one advocacy group when it observed that in many years more American consumers are struck by lightning than win a monetary award in arbitration.[3]

Consumer products and services companies are keenly aware that arbitration clauses insulate them from liability. One lawyer defending against class actions described arbitration clauses as a “silver bullet” for defeating consumer cases,[4] while another acknowledged that a “claim that is $162 – an individual claim – is not one that any rational litigant would litigate.”[5] In Judge Richard Posner’s words: “The realistic alternative to a class action is not 17 million individual suits, but zero individual suits, as only a lunatic or a fanatic sues for $30.”[6]

Arbitration and Consent

Arbitration derives its legitimacy from consent. As the Supreme Court has noted, “[a]rbitration under the [FAA] is a matter of consent . . . .”[7] But whether consumers genuinely agree to arbitration is debatable.

Research demonstrates that consumers cannot understand arbitration clauses or their impact. Thus, an empirical study of consumer understanding of an arbitration clause in a credit card contract found that less than 9 percent of the respondents realized both that the contract included an arbitration clause and that it blocked them from suing in court.[8] Despite that contract’s class action waiver, four times as many respondents thought they could still participate in a class action as recognized that by agreeing to the contract they would surrender their right to join a class action. Even when respondents were told to assume they had agreed to a contract barring them from joining in a class action, less than a third realized they were foreclosed from doing so. Just one respondent in 16 realized both that (1) the contract they had been shown would prevent them from joining a class action, and (2) as a general matter, class action waivers block participation in class actions. When consumers can neither recognize that they are waiving the right to participate in a class action nor that such a waiver would be given effect, it is difficult to justify the claim that they have consented.

A CFPB telephone survey found that a majority of its respondents believed they could join a class action despite having agreed to a contract that included a class action waiver.[9] Similarly, only one consumer in 14 understood that an arbitration clause would block them from proceeding in court. And a more recent study also found consumers do not understand arbitration clauses.[10]

At the end of the day, if consent – the source of arbitration’s legitimacy – means no more than signing a contract that consumers cannot understand, it is hard to see arbitration as legitimate.

Efforts to Carve Out Consumer Claims From the FAA

Members of Congress have repeatedly but unsuccessfully introduced bills to amend the FAA to eliminate consumer disputes from its coverage. In the 2010 Dodd-Frank Act, Congress authorized the CFPB to regulate arbitration.[11] The CFPB issued a rule which would have barred the use of class action waivers in arbitration clauses in consumer financial contracts.[12] But Congress invoked the Congressional Review Act (“CRA”)[13] to block the CFPB’s rule from going into effect.

The CFPB should issue a different arbitration rule. The Congressional Review Act bars administrative agencies from issuing “a new rule that is substantially the same” as the rule Congress struck down.[14] That bars the bureau from producing a rule banning class action waivers. Nevertheless, that still leaves the bureau options. Indeed, consumer protection advocacy groups recently petitioned the bureau to promulgate a new rule blocking the use of arbitration clauses in consumer financial contracts. The petition differs from the CFPB’s blocked rule because the regulation it calls for would not be limited to class action waivers and because the proposed regulation would be based on lack of consumer comprehension of arbitration clauses rather than the claim-suppression effect of class action waivers.

Conclusion

Arbitration clauses have become common in consumer contracts as a device to block the filing of consumer class actions against businesses catering to consumers. Consequently, it no longer makes economic sense to assert many consumer claims, and therefore companies are insufficiently deterred from violating some consumer protection laws. Using arbitration clauses to preclude class actions lacks legitimacy because consumers do not knowingly consent to arbitration. Congress should amend the FAA to exclude consumer claims from its coverage, or, failing that, the CFPB should use its authority under the Dodd-Frank Act to protect consumers against the use of arbitration clauses in consumer financial contracts.

We continue to assist homeowners who are transitioning from Covid-era mortgage Forbearance programs to permanent loan modifications that make mortgage payments more affordable. If you are currently attempting to negotiate a loan mod and need assistance, please contact us right away. Our knowledgeable and experienced Foreclosure Defense team, which includes Whitney Kaster, Andy Engel, Javier Merino, Karen Ortiz, Amanda Severt and Roberto Rivera, are here to help homeowners in Ohio, New Jersey, and New York.

We continue to assist homeowners who are transitioning from Covid-era mortgage Forbearance programs to permanent loan modifications that make mortgage payments more affordable. If you are currently attempting to negotiate a loan mod and need assistance, please contact us right away. Our knowledgeable and experienced Foreclosure Defense team, which includes Whitney Kaster, Andy Engel, Javier Merino, Karen Ortiz, Amanda Severt and Roberto Rivera, are here to help homeowners in Ohio, New Jersey, and New York.  Bringing class action lawsuits on behalf of consumers and other parties damaged by corporations, banks, lenders, and other entities is the fastest growing part of our practice. If you believe a company, no matter how large or small, is systematically cheating you and other customers, please give us the opportunity to investigate and determine if class action claims exist. Our Class Action Practice Group which includes Javier Merino, Brian Flick, Andrew Wolf, Jeff Crossman, Saher Chaudhary, Marita Ramirez, Kim White and Liza Marigliano has filed significant cases against these and other companies:

Bringing class action lawsuits on behalf of consumers and other parties damaged by corporations, banks, lenders, and other entities is the fastest growing part of our practice. If you believe a company, no matter how large or small, is systematically cheating you and other customers, please give us the opportunity to investigate and determine if class action claims exist. Our Class Action Practice Group which includes Javier Merino, Brian Flick, Andrew Wolf, Jeff Crossman, Saher Chaudhary, Marita Ramirez, Kim White and Liza Marigliano has filed significant cases against these and other companies: Far too many companies have failed to adequately protect their customers’ and/or employees’ confidential personal information. As a result, cyberthieves have been able to access and utilize victims’ social security numbers, medical records, bank account information, and other sensitive data at an alarming rate.

Far too many companies have failed to adequately protect their customers’ and/or employees’ confidential personal information. As a result, cyberthieves have been able to access and utilize victims’ social security numbers, medical records, bank account information, and other sensitive data at an alarming rate.  If you received a postcard regarding the Madyda v. BMV case, it is because you are one of the people who paid a fee to have your driver’s licensed laminated by a deputy registrar between 2018 and 2020, even though the deputy registrars were not performing the service.

If you received a postcard regarding the Madyda v. BMV case, it is because you are one of the people who paid a fee to have your driver’s licensed laminated by a deputy registrar between 2018 and 2020, even though the deputy registrars were not performing the service.

As most of you know, the next hearing in the supplemental unemployment benefit case is scheduled for Tuesday, January 24, 2022 before Franklin County Common Pleas Court Judge Michael Holbrook. If you are interested in attending the hearing it will be conducted in Courtroom 5B in the Franklin County Courthouse which is located at 345 High Street in Columbus. The hearing may also be viewed via a live stream here: https://www.fccourts.org/480/Live-Stream

As most of you know, the next hearing in the supplemental unemployment benefit case is scheduled for Tuesday, January 24, 2022 before Franklin County Common Pleas Court Judge Michael Holbrook. If you are interested in attending the hearing it will be conducted in Courtroom 5B in the Franklin County Courthouse which is located at 345 High Street in Columbus. The hearing may also be viewed via a live stream here: https://www.fccourts.org/480/Live-Stream