A group of current and former employees of the Montgomery County Office of the Public Defender have filed a class action lawsuit in the United States District Court for the Southern District of Ohio, seeking to address longstanding disparities in compensation and resources between public defenders and prosecutors in Montgomery County. The lawsuit, brought by Michael Dailey, William Ehrstine, Susan Souther, Travis Dunnington, Paul Nerone, Cynthia Packet, and Debra Burs on behalf of all similarly situated employees, names Montgomery County and the Montgomery County Public Defender Commission as defendants.

A group of current and former employees of the Montgomery County Office of the Public Defender have filed a class action lawsuit in the United States District Court for the Southern District of Ohio, seeking to address longstanding disparities in compensation and resources between public defenders and prosecutors in Montgomery County. The lawsuit, brought by Michael Dailey, William Ehrstine, Susan Souther, Travis Dunnington, Paul Nerone, Cynthia Packet, and Debra Burs on behalf of all similarly situated employees, names Montgomery County and the Montgomery County Public Defender Commission as defendants.

The complaint alleges that Montgomery County and its Public Defender Commission have systematically failed to provide public defenders with salaries, benefits, and resources that are substantially equivalent to those provided to prosecutors, as required by Ohio law and the United States and Ohio Constitutions. The plaintiffs assert that this disparity violates their rights to equal protection and due process, as well as the constitutional guarantee of effective assistance of counsel for indigent defendants.

According to the complaint, Ohio Administrative Code Section 120-1-06 mandates that public defender attorneys’ salaries “shall approximate and be in parity with the compensation received by prosecutors with comparable years in practice and experience.” The lawsuit details significant gaps in pay and bonuses between the two offices, with prosecutors receiving far greater compensation and additional year-end bonuses, while public defenders are left behind.

The plaintiffs seek damages, back pay, and injunctive relief to compel Montgomery County to comply with its legal obligations and ensure parity in pay and resources between public defenders and prosecutors. The complaint also requests a writ of mandamus requiring the County to take all necessary actions to bring the Public Defender’s Office into compliance with state law and constitutional mandates.

“This lawsuit is about fairness, equality, and the right of every person—regardless of income—to have access to effective legal representation,” said Nicole M. Lundrigan, attorney for the plaintiffs. “Montgomery County’s failure to provide public defenders with equal pay and resources not only harms dedicated public servants but also undermines the constitutional rights of the people they serve.”

“We intend to vindicate the constitutional rights of both criminal defendants in Montgomery County and the lawyers and support staff represent them” added Marc Dann of co-counsel Dann Law

The class action seeks to represent all past and present employees of the Montgomery County Office of the Public Defender from 2015 to the present.

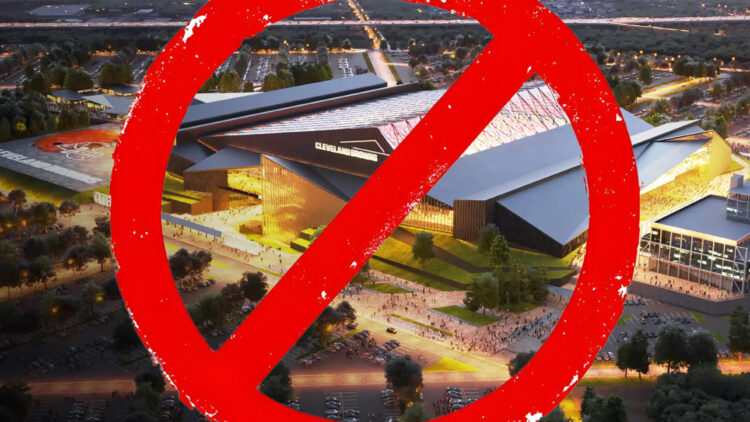

DannLaw filed a class action lawsuit in Franklin County Common Pleas Court on Monday, July 7, 2025 seeking an injunction to stop the State of Ohio from confiscating more than $1,000,000,000 from the state’s Unclaimed Funds Account (UFA) and using the money to underwrite a proposed new stadium for the Cleveland Browns as well as other privately owned sports facilities. A scheme mandating the seizure and diversion of UFA funds was included in the recently enacted state budget.

DannLaw filed a class action lawsuit in Franklin County Common Pleas Court on Monday, July 7, 2025 seeking an injunction to stop the State of Ohio from confiscating more than $1,000,000,000 from the state’s Unclaimed Funds Account (UFA) and using the money to underwrite a proposed new stadium for the Cleveland Browns as well as other privately owned sports facilities. A scheme mandating the seizure and diversion of UFA funds was included in the recently enacted state budget.

COLUMBUS, OH — Former Ohio Attorney General Marc Dann and former State Representative Jeffrey A. Crossman announced today that they will challenge the legality of using $600 million from Ohio’s Unclaimed Funds Trust (UFT) to finance a new stadium for the Cleveland Browns if the scheme is included in the Fiscal Year 2026/2027 biennial budget and signed into law.

COLUMBUS, OH — Former Ohio Attorney General Marc Dann and former State Representative Jeffrey A. Crossman announced today that they will challenge the legality of using $600 million from Ohio’s Unclaimed Funds Trust (UFT) to finance a new stadium for the Cleveland Browns if the scheme is included in the Fiscal Year 2026/2027 biennial budget and signed into law.